NHAI sees drastic drop in bids for road projects

May 28, 2012

The NHAI, responsible for managing a network of highways in India, is expecting the number of pre-qualified bidders for road projects to drop drastically this fiscal as the sector heads for a consolidation phase.

Last year, 99 firms had qualified for the annual pre-qualification process which ensures that companies can submit financial bids instead of going through the two-stage bidding process.

“The market is somewhat indifferent. A couple of companies have defaulted on their financial closures recently. The number of companies may come down but fewer players will emerge stronger,” said a senior official of NHAI, who thinks the time is ripe for a shake-up.

Abhaya Agarwal, executive director and leader PPP, at Ernst and Young, says the current year may see a limited number of projects being put up for award than in the past because fewer detailed project reports (DPRs) got completed.

The official also said a lot of projects might find it extremely difficult to achieve financial closure. “Newer players are coming in and bidding without measuring risks. Some banks are of the view that total project cost calculated is not being subjected to the scrutiny that should be done. We may see bigger companies buying out projects from smaller companies at lower valuation,” said the NHAI official.

Agarwal also said tightening of the liquidity situation has made financing of future projects difficult as banks have exhausted their infrastructure fund and are close to reaching their exposure limit for road funding.

“In addition, financial closure for more than 70% of the NHAI projects is yet to be achieved, the concession agreements for which were signed last year and would require huge funding. Hence, in terms of loan disbursement to the infrastructure sector, we may not see the same rate of expansion in the next two years as we have seen in the past two,” added Agarwal.

Companies like Reliance Infrastructure and IRB Infrastructure, which have a chunk of their order book in the road sector, view this phase as a challenging one.

“Consolidation is due in the sector as roads industry today is fragmented with around 90 players. There are players who have entered with a view to increase order book and are finding it difficult to manage construction challenge. Traffic revenue in projects, which have been bid aggressively, will find it difficult to honour commitments to NHAI premium and debt servicing,” said a Reliance Infrastructure spokesperson.

“The bids have been very aggressive and banks have found it difficult to fund these projects. Financial closures have been made based on over-optimistic revenue models. Yes, the proverbial bubble is ready to burst,” said Virendra Mhaiskar, managing director of IRB Infrasructure Developers Ltd, one of the largest road developers in the country.

Mhaiskar feels that consolidation has already begun with IRB taking over a BOT asset in Tamil Nadu and Essel making an attempt to take over a major player like IVRCL. According to Fitch’s report, the actual first year traffic is usually lower by around 45% in many toll projects.

SOURCE:http://economictimes.indiatimes.com/

Ramky Infra Bags Rs.1,248.95 Orders

May 14, 2012

(RTTNews) – Ramky Infrastructure Ltd. said it had bagged new orders aggregating to Rs.1,248.95 crore across the nation covering the State of Arunachal Pradesh, Bihar, Chandigarh, Gujarat, Karnataka, Madhya Pradesh, Odisha, Tamil Nadu, Tripura and West Bengal and across industrial, irrigation, road and power verticals.

Some of the major projects secured by the company are furnished below.

In Arunachal Pradesh, it has secured orders for Rs.192.01 crore – one for Rs.99.42 crore from HSCC (India) Ltd. for strengthening and up-gradation of General Hospital at Naharlagun and another one for Rs.92.59 crore from the Government of Arunachal Pradesh for 2 laning from Yingkiong to Gobuk in Arunachal Pradesh under Arunachal Pradesh package of SARDP-NE.

In Bihar, it has been awarded a project valued Rs.109.38 crore by NTP Ltd. for SG Area Balance Civil Works Package for Barh STPP State-1 (3×660 MW).

In Gujarat it has secured a project for Rs.98.60 crore from Gujarat Water Supply and Sewerage Board for design, build, operate and construct of Kadana Dam based bulk pipe line scheme for Dahod City.

In Madhya Pradesh, the company has been awarded projects totaling Rs.425.46 crore – one for Rs.131.43 crore from Narmada Valley Development Authority for execution of the Nagod (Satna) Br. Canal and its completed distribution system up to 40 hect. Chak of Bargi Diversion project on turnkey basis, and the second one was for Rs.123.08 crore from Narmada Valley Development Authority for execution of the Rewa Branch Canal and Sanaura Sub Branch Canal, including its complete distribution system up to 40 hect. Chak of Bargi Diversion Project on turnkey basis.

The third one was for Rs.87.18 crore from Madhya Pradesh Road Development Corporation Ltd. for regarding, strengthening, widening, maintaining and operating of Jabalpur-Patna-Shahpura Road on BOT (Toll plus Annuity) basis. The concession period for the project is 15 years including two years construction period.

M.P. Paschim Kshetra Vidyut Vitaran Co. Ltd. placed an order for Rs.83.77 crore for supply of materials, survey, installation, testing and commissioning of 33/11kV substation, augmentation of capacity of power transformer and providing additional power transformer in existing 33/11lkV S/s with extension of 33kV and 11kV Bay along with VCB, laying of single circuit/double circuit 33kV and 11kV lines, augmentation of conductor of existing 33kV and 11kV lines and renovation works of existing 33/11kV S/S, installation of new 63 KVA/100 KVA/200 KVA/315 KVA DTRs at identified location along with associated 11kV line.

(RTTNews) – In West Bengal, it had been awarded a project for Rs.152.69 crore by the Government of West Bengal Irrigation & Waterways Department for reconstruction, remodeling & improvement of embankment in Sundarbans and adjoining areas in the districts of North & South 24-Parganas, West Bengal, damaged by severe cyclone ‘Aila’.

At the BSE, Ramky Infrastructure shares are currently trading at Rs.195..40, up 2.25 percent from the previous close.

Source: http://www.rttnews.com

3,000 km of 2-lane roads a lifeline for smaller builders

May 14, 2012

The National Highway Authority of India (NHAI), the government-backed autonomous manager of highways, plans to build one-third (or 2,800 km) of this fiscal’s target of 8,800 km long of road network in the form of two-lane roads on cash contracts.

JN Singh, member-finance of the NHAI, said, “As most of the two-lane roads lack heavy traffic, the projects would be awarded on EPC (engineering procurement and construction) or cash contract basis rather than on BOT (build-operate-transfer) or BOOT (build, own, operate and transfer) basis.”

The two-lane projects, therefore, may not attract big BOT developers that covet only mega highways that yield higher margins.

So, smaller road construction firms ravaged by stiff competition, margin pressure, high interest cost and stretched balance sheets may find the cash contracts manna from heaven.

For, the two-lane projects may entail work orders worth up to Rs15,000 crore.

A report by Merrill Lynch said pure road contractors such as IVRCL and NCC could benefit.

Agreed Pankaj Kumar, senior analyst at KJMC Capital Market

Services. This fiscal, he said,

could prove to be a good year for BOT players-cum-road contractors such as IVRCL, HCC, Nagarjuna Construction. But pure BOT developers may find the going tough.

Last fiscal, the NHAI awarded 35 projects. All were for four-lane or six-lane roads, and 23 projects garnered premium status, fetching Rs24,200 crore in net present value (NPV) for the NHAI. (NPV is the difference between the present value of cash inflows and outflows.)

Singh said projects this fiscal would not fetch such huge NPV. Value of orders will also decline due to shift to two-lane orders.

The NHAI will fund the two-lane projects with capital raised from tax-free infrastructure bonds.

Land acquisition and annuity projects should not pose a problem as it had raised Rs10,000 crore last fiscal through bonds.

It has also received approval for an additional bond issue of Rs10,000 crore this fiscal.

Besides, a recent report by Motilal Oswal Securities said the NHAI rakes in Rs9,200 crore in cess, Rs3,000 crore in toll collections and Rs3,000 crore in premium, which would help it in meeting recurring EPC obligations and annuity projects.

The report also stated that intense competition in the road sector is likely to ease due to challenging macroeconomic environment and with established players committing their capital to large infrastructure projects.

The road sector may see consolidation as aggressive bidding, lower-than-expected tariffs, rising funding cost and execution delays have considerably lowered returns on projects, the Motilal report added

Source: www.dnaindia.com

Now road toll can be paid without stopping at plazas

April 20, 2012

Union Minister for Road Transport and Highways C.P. Joshi on Thursday unveiled India’s first Radio Frequency Identification (RFID) technology-based Electronic Toll Collection (ETC) Plaza at Chandimandir here. He also inaugurated the four-lane Zirakpur-Parwanoo section of National Highway 5 passing through Punjab, Haryana and Himachal Pradesh.

Calling for coordinated efforts by the Central and State governments for making India a developed nation, Dr. Joshi said: “A qualitative infrastructure development is the need of the hour.”

Stating that a thrust to infrastructure development had been given in the 11th and coming 12th Five-Year Plans to increase the national Gross Domestic Product, he said the endeavour was to facilitate the common man with new technology and better road transportation facilities.

Dr. Joshi said all the highways in the country would be enabled with RFID technique that “helps users to pay the toll tax without stopping at toll plazas and reduces traffic congestion and commuting time.”

“Toll statements can also be made available online to the road users and they need not stop for the receipt,” he added.

He said his Ministry would consider giving exemptions and concessions to a certain category of users as per the request of Haryana Chief Minister Bhupinder Singh Hooda and his Punjab counterpart, Parkash Singh Badal, besides that of Union Culture Minister Kumari Selja and Haryana PWD Minister Randeep Singh Surjewala.

Dr. Joshi, however, asserted that the need of the hour was to rise above populism as the companies which had created huge infrastructure had to recover their costs through toll collection.

Referring to the “bottlenecks” faced by residents of Panchkula, he said these would be technically examined.

He disclosed that the National Highways Authority of India (NHAI) has completed projects worth Rs. 1,913 crore in Haryana, Rs. 1,419 crore in Punjab and Rs. 50 crore in Himachal Pradesh. He added that the NHAI would take up major road projects measuring 1,167 km in Haryana, Punjab and Himachal Pradesh during the current financial year.

Mr. Hooda said this project would benefit the people of Haryana, Punjab and Himachal Pradeshas they would not have to face traffic jams on the highway. He urged the Union Minister to formally approve various roads in Haryana as National Highways which had been approved in-principle.

Local MP Kumari Selja demanded the conversion of the Saha-Ambala stretch into a national highway.

Mr. Badal stated that the payment of toll, though unpalatable to the public, had become a necessity and there was no way out.

RFID tags

Meanwhile, ICICI Bank officials said the bank was working with the toll operators for issuing RFID tags to road users to be read at the toll plazas. Users, who need to register themselves, could use the tags across multiple toll plazas; they could be updated and would act as a record for settlement of financial transactions of the toll operators.

KNR Constructions completes NHAI project in record time

April 19, 2012

HYDERABAD: Hyderabad-based construction firmKNR Constructions has completed the Bijapur-Hungund toll road of National Highways Authority of India (NHAI) nearly 11 months ahead of schedule and claimed it a record in the history of Indian highways.

The four lining of 97.22 kilometres of road project, valued at Rs 905.5 crore, was completed in 582 days as against the scheduled duration of 910 days.

NHAI had awarded the project on design, build, finance, operate and transfer (DBFOT) basis to a special purpose vehicle of Sadbhav Engineering, which in turn awarded the project to KNR Constructions, an EPC (engineering, procurement and construction) contracting firm.

“The primary motivation to complete the project much ahead of schedule was the attraction of earning a bonus of Rs 16 lakh per every single day of early completion. In the process, we ended up with earning a bonus of around Rs 50 crore for early completion,” Executive Director K. Jalandhar Reddy told ET.

As a part of achieving the target, he said, the company has paid additional compensation to the land owners towards expeditious land acquisition, apart from deploying modern imported construction equipment and adopting best sourcing and keeping a strong supply chain of raw material.

“Most of the concessionaries are bagging the road projects these days at very thin margins owing to aggressive bidding and early execution of projects by EPC contractors will significantly help them improve their financials,” said Reddy.

Further, he said in the backdrop of not securing BOT road projects from NHAI owing to not so aggressive bidding strategy, KNR will now focus largely on EPC road contracts and help the BOT players with its strong execution skills.

KNR, with Rs 1,051 crore revenue last fiscal, now has an order book of Rs 3,396 crore comprising of Rs 3,253 crore of road EPC contracts, said Reddy.

Source: http://economictimes.indiatimes.com

At 8,000 kms, Road Ministry awards 57% more work in FY12

April 3, 2012

NEW DELHI: Road ministry has ended the year on a high as it has awarded 62 projects covering 7,957 kms in the current fiscal, 57% higher than the previous year. The government is all set to achieve its earlier announced target of building 20 kms of road per day by 2013-14, as it has completed construction of 2,250 kms road in 2011-12, in comparison to 1,784 kms in the previous year.

In 2011-12, National Highways Authority of India(NHAI) has awarded 49 projects of 6,491 kms and the ministry awarded 13 projects for 1466 kms through state agencies. In all, 62 projects of 7,400 kms have already been awarded as against the target of 7,300 kms.

Some of the projects awarded have offered premium to the government and is likely to result in additional revenue generation of Rs 30,400 crore during the concession period.

“We want to accelerate this achievement further in 2012-13. We are confident of achieving the target of 8800 kms, said CP Joshi, Union Minister of Road, Transport and Highways. Joshi added that bids for 1,500 kms are either under evaluation or due in April,2012.

In the recent bids, which opened on March 28 and March 30, NHAI received a phenomenal response with road project developers providing premium on seven projects that would earn Rs 6,451 crore whereas one project sought a premium.

Companies like L&T, Sadbhav Engineering and IVRCL were amongst some of the successful bidders for 8 projects entailing highway development of 1,144 kms, having an estimated cost of Rs 11,500 crore. IVRCL will provide the highest premium at Rs 145 crore. “The bids are far better than what we had anticipated. Even the single project which asked for grant, it was much lesser than our estimates,” said an NHAI official.

These companies have opted to provide premium to the government, instead of taking viability gap funding. The government provides VGF or grant to the project developers for ensuring viability of the projects.

L&T won two bids and thus would be completing the full stretch from Gujarat border to Amravati. This road connects Hazira port -Surat to Paradip and eventually Kolkata.

In addition, 3 projects in NHAI of 318 Kms. and 5 projects in the Ministry of 664 Kms. i.e. 982 Kms. in all, bids have been received, which are under evaluation and decision is to be taken soon. It is possible that the government may award a few hundred kms if some of these projects are cleared tomorrow.

Ministry bid to meet highway target is a boon for infra cos

April 2, 2012

The timing chosen by the Highways Ministry — the last four days of the fiscal just ended — to open bids worth Rs 11,564 crore would end up fattening the order-books of many listed infrastructure companies, apart from helping the ruling UPA-II alliance meet its target of awarding 7,400 km of highways.

“In what may be an unprecedented move, the Highways Ministry and NHAI issued the Letters of Intent (LoI) the very next day after the bids were opened, that too on a Saturday, a Government holiday. The LoIs will help companies book orders, and maybe earn revenues, for fiscal 2011-12 — without raising any eyebrows. Earlier, firms have booked orders without LoIs in hand, but with a disclosure.

The listed companies that gained from the year-ender round of bidding include Larsen & Toubro Infrastructure, Unity Infraprojects, IVRCL and Sadbhav Engineering. Over Rs 7,600 crore of projects, or 65 per cent of total bids opened, were bagged by firms listed on the stock exchanges.

IMPACT ON L&T

With these bids, Larsen and Toubro, the parent firm of the largest beneficiary of these bids, L&T Infrastructure, will inch closer to achieving its order-book guidance of five per cent year-on-year growth. L&T Infra grabbed projects worth Rs 4,500 crore, or 40 per cent of the bids opened in value terms, was the largest gainer from the last four days of bids.

“As on March 30, L&T (parent company) required about Rs 34,340 crore inflows in the fourth quarter of fiscal 2012 to achieve its stated guidance,” an analyst of a brokerage firm tracking L&T told Business Line, requesting anonymity as he is not permitted to speak to media.

In the nine months ended December 2012, L&T had reported inflows of Rs 49,420 crore, which implies flat year-on-year growth. Even before these bids were opened on March 30, L&T had announced orders of Rs 12,090 crore during the fourth quarter of financial 2012, added the analyst.

Due to these bids, order-books of Sadbhav Engineering would increase by Rs 1,102.48 crore, IVRCL Rs 1,617 crore and Unity Infraprojects Rs 438.75 crore.

SPECIAL RELAXATION

These projects, which would help develop 1,100 km of highways, were a part of the Highway Ministry’s award list firmed up early in fiscal 2012. But to ensure that the projects did not spill over to FY 2013, an empowered Group of Ministers (eGoM) stepped in to allow relaxation of a required approval process.

The relaxation ensured that the Ministry could approach the Cabinet Committee of Infrastructure directly for approval, instead of the Public Private Partnership Appraisal Committee (PPPAC). The Highways Ministry made this proposal a day after Mr Pulok Chatterjee asked it to expedite awarding 15 major projects requiring construction of 1,547 km during fiscal 2012.

The mandatory PPPAC approval for these projects had got delayed for months. The Highways Ministry was informed that the nod was getting delayed because the appraisal note had not come in from the Planning Commission, one of the members of the PPPAC. This made the Ministry escalate the issue as it was affecting project targets.

This relaxation has helped the UPA-II Government achieve its target of awarding highway projects of 7,300 km, with the Finance Minister, Mr Pranab Mukherjee, announcing in the Budget that the Government is on track to meet its target of awarding 7,300 km of highways.

The bidding process did follow the annual pre-qualification and e-tendering methodologies, both aimed at removing discretionary powers and increasing competition.

Source: http://www.thehindubusinessline.com

Highway construction goes into top gear

April 2, 2012

NHAI hastens award of projects covering 5,400 km this financial year, road construction increases to 7 km a day

The pace of road construction in the first three years of the United Progressive Alliance (UPA) government’s second term has increased to seven km a day, compared with 4.1 km a day in the previous three years. However, this is still below the ambitious 20-km a day target set by the government.

The pace of road construction in the first three years of the United Progressive Alliance (UPA) government’s second term has increased to seven km a day, compared with 4.1 km a day in the previous three years. However, this is still below the ambitious 20-km a day target set by the government.

Officials said so far, the National Highways Authority of India (NHAI) has awarded projects covering about 5,400 km in this financial year, against a target of awarding 59 projects covering 7,300 km, with a total cost of about Rs 60,000 crore. The authority is expected to hasten the award of projects in the next few days to come as close to the target as possible

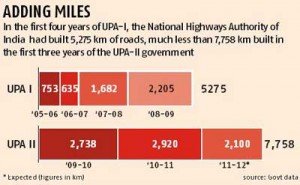

In the last three years of UPA’s first term — 2006-07, 2007-08 and 2008-09 — NHAI constructed 4,522 km of highways. This increased to 7,758 km in the first three years of the current term.

At about 2,100 km, 2011-12 would see the lowest national highway construction in the last four financial years. A senior NHAI official said, “We will be able to construct 2,100 km of roads this year. This year’s construction is low because of less number of awards in 2008-09. Our award plans went haywire in 2008-09 because of the recession in the global market.” He added the completion of projects by the authority was below the target of 2,500 km of highways in the current financial year.

The award and construction of road projects had slowed during the first term of the UPA government. While the economic slowdown and the ensuing liquidity crunch had hit performance and kept companies away, T R Baalu’s record as the road transport minister was also not satisfactory.

In mid-2009, UPA came to power for the second time and Kamal Nath was appointed surface transport minister. He had set a target of 20 km a day, increasing it from the target six km a day in 2008-09. During his tenure, Nath had come up with project plans for two financial years and had set a target of awarding a little over 200 projects, worth Rs 200,000 crore. The pace of awarding road projects and construction of roads improved under the new minister, C P Joshi.

The highways authority has also awarded over 21 projects on premium that is expected to fetch around Rs 3,000 crore a year. A company offering a premium shows it is committing to an annual payment to the government over a period of time, instead of seeking a grant for building roads. Companies bid a premium if these are confident the accruing toll revenue would more-than-offset their costs.

The premium income is also set to bring down NHAI’s borrowing. It would now have to borrow only Rs 83,000 crore till 2030-31. The B K Chaturvedi committee, appointed in 2009 to examine the National Highways Development Programme and related aspects (it gave its second report last year), had said NHAI would need to raise Rs 191,000 crore by 2030-31.

NHAI terminates Goa contract to IRB Infrastructure

December 27, 2011

IRB Goa Tollway Pvt. Ltd. will claim compensation as per Termination payment provisions of the Concession Agreement.

IRB Infrastructure Developers Ltd has announced that the National Highways Authority of India (“NHAI”) had issued Letter of Award (“LOA”) on January 05, 2010 to the Company for the Project of Four Laning of Goa/ Karnataka Border to Panaji – Goa stretch of NH-4A from Km 84.000 to Km 153.070 in the State of Goa on BOT Toll Basis on DBFO pattern (the “Project”). The Company had subsequently incorporated Special Purpose Vehicle (SPV) i.e. IRB Goa Tollway Pvt. Ltd. – wholly-owned Subsidiaries of the Company for implementation of this Project. IRB Goa Tollway Pvt. Ltd. had executed Concession agreement with the NHAI in February 2010 and subsequently the Project had also achieved financial closure in March 2010. Construction period of the Project was 30 months.

However, NHAI could not provide necessary Land for implementation of the Project. Considering substantial delay in providing the Land, the Company had removed the Project from its Consolidated Order Book as on September 30, 2011 as a measure of Good Corporate Governance and accordingly modified Order book was represented in the presentation uploaded on the Company’s website.

Now, the Company have received a formal letter from NHAI informing the Company, termination of this concession agreement of the Project due to their inability to provide necessary Land for implementation of the Project. In this regard, IRB Goa Tollway Pvt. Ltd. will claim compensation as per Termination payment provisions of the Concession Agreement.

Source: indiainfoline.com

Indian stock market and companies daily report (December 26, 2011, Monday)

December 27, 2011

Indian markets are expected to open in the green following positive cues from opening trade in most of the Asian markets today and gains in US markets on Friday. There was quite a lot of volatility, but the Indian markets managed to end in the green, gaining close to 1.5% over the last week.

US stocks closed higher on encouraging economic reports as the number of Americans that applied for unemployment benefits dropped last week to the lowest level since April 2008 in the latest sign that the job market is healing. The Conference Board also reported that its measure of future economic activity had a big increase in November. It was the second straight gain, signalling that the US economy is picking up some speed.

The markets will closely track the developments on the domestic front; RBI is likely be more watchful now as moderating inflation is likely to resolve the predicament of trimming interest rates in order to support growth. Nonetheless, one cannot rule out the pessimism surrounding the policy paralysis on the macro front which, in tandem with weakening of global cues, can reverse the market directions.

Markets Today

The trend deciding level for the day is 15,774 / 4,724 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 15,876 – 16,014 / 4,754 – 4,794 levels. However, if NIFTY trades below 15,774 / 4,724 levels for the first half-an-hour of trade then it may correct up to 15,636 – 15,534 / 4,684 – 4,653 levels.

Increase in NRE FD rates

Following the deregulation of NRE Savings and Fixed Deposit rates by the RBI, several banks, including smaller private banks such as Yes Bank as well as larger ones such as HDFC Bank have aggressively increased the rates on these deposits. NRE FDs are rupee denominated accounts meant for NRI customers on which the interest earned is tax-free. For banks, these deposits are a source of raising rupee funds just like ordinary domestic FDs.

Hence, following the deregulation, several banks have increased the rates offered on these accounts close to their domestic FD rates (as in case of HDFC Bank offering 8.5% on NRE FDs less than Rs.15 lakhs vs. 9.25% on domestic FDs) or in some cases equal to their domestic FD rates (as in case of Yes Bank offering 9.6% on both domestic and NRE FDs as well as 7% on domestic and NRE savings accounts greater than Rs.1 lakh). Prior to the deregulation, interest rate on NRE FDs had been increased on November 23, 2011, by 100bp to LIBOR+275 bp (which worked out to about 3.75-4%). Considering that the interest on these FDs is tax-free, at about 8.5-9.5%, in our view this represents a compelling return (and a massive jump from the rate hardly a couple of months back of 2.75-3%), which could attract significant NRI inflows into the country.

Within the banking sector, Federal Bank and South Indian Bank have a disproportionately large share of NRE deposits in their overall funding mix at about 12% and 8.5%, respectively. Immediately post the deregulation, both the banks had increased their NRE FD rates to around 6.5%, but following the recent moves by other private banks, Federal Bank has also raised the rate to 8.25-9.10% and South Indian Bank’s management has also indicated that by Monday it will hike NRE FD rates to similar levels (management has indicated that it is unlikely to hike rates on NRE savings account). Hence, the low-cost advantage of these FDs vis-à-vis domestic FDs is expected to erode going forward. Also, so far, rates on NRE savings accounts were higher than NRE FD rates prior to the deregulation, but now with NRE FD rates being more than 500bp higher, a large part of NRE savings balances of these banks are also likely to move to NRE FDs.

Assuming that the entire NRE term and savings balances re-price gradually over the next one year to the new NRE FD rates, the impact on the NIMs could be up to 35bp for South Indian Bank and up to 45bp for Federal Bank. In any case, both these stocks (along with other older private sector banks) have outperformed of late, and current valuations at about 1x P/ABV are significantly higher than mid-size PSU banks with similar or better fundamentals. Accordingly, we downgrade both stocks to Neutral.

IRB’s Goa road BOT project terminated by NHAI

IRB’s Goa road BOT project (TPC: Rs.833cr) has been terminated by NHAI (formal letter received by IRB) due to NHAI’s inability to provide land for implementation of this project. This move by NHAI was on expected lines as IRB had removed this project from its order book in 2QFY2012 and subsequently we had factored the same in our model (read IRB 2QFY2012 result update). Further, according to management, IRB will claim compensation charge as per the provisions of the concession agreement.

Project details: IRB had received LOA from NHAI on January 5, 2010, for the four laning of Goa/ Karnataka Border to Panaji – Goa stretch in Goa on BOT toll basis. The company had subsequently incorporated SPV – IRB Goa Tollway Pvt. Ltd. (wholly owned subsidiary of IRB) for the project’s implementation. IRB Goa Tollway Pvt. Ltd. had executed concession agreement with the NHAI in February 2010 and subsequently the project had also achieved financial closure in March 2010. Construction period of the project was 30 months. However, NHAI could not provide necessary land for implementation of the project.

We have arrived at an SOTP-based target price of Rs.182/share, which implies an upside of 30.0%. Hence, we recommend a Buy rating on the stock.

Monnet Ispat Board approves share buyback

Monnet Ispat Board has approved share buyback upto Rs.100cr from the open market at a price not exceeding Rs.500/share. We expect the company to finance the buyback program from its internal accruals as it has been consistently generating quarterly EBITDA in excess of Rs.100cr. The share buyback could boost Monnet Ispat’s FY2013 EPS by 3-5%, depending on the average cost of shares bought back. We maintain our Buy recommendation on the stock with an SOTP target price of Rs.528.

Discontinuation of coverage

We have discontinued coverage on the following stocks: Electrosteel Castings, Godawari Ispat, Prakash Industries, Sarda Energy, Gujarat Gas, Gujarat State Petronet, Indraprasth Gas and Petronet LNG.

Economic and Political News

– Energy deficit may rise up to 15% as weak rupee hurts coal imports

– Forex reserves dip by US$4.67bn

– FDI dips 50% to US$1.16bn in October 2011

– State run banks told to discard fast-track promotion policies

Corporate News

– Oil Ministry says no provision for penalty in RIL’s KG-D6 contract

– Power trading firms hit by payment delay

– Domestic airfares fall as capacity rises

– Coal India will switch to new pricing mechanism from January 2012

Source: stockmarketsreview.com