The road ahead for Virendra Mhaiskar and IRB India

December 10, 2012

Virendra Mhaiskar has made IRB India’s largest and most profitable toll-road operator. In a sector that has most companies reeling under debt, he seems to be the rare animal with enough cash on hand

Name: Virendra Mhaiskar

Age: 41

Profile: Chairman and managing director, IRB Infrastructure

Rank in Rich List 2012: 96

Net Worth: USD560 mln

The Big Hairy Challenge faced in the last one year: Slowdown in the infrastructure business, public protests against toll payments, and allegations of political links

The Way Forward: Focusing on project execution, particularly on the Ahmedabad-Vadodara BOT project

Virendra Mhaiskar must be incredibly crazy. There is nothing else that explains the kind of risks the 41-year-old chairman and managing director of IRB Infrastructure takes, and his rise as India’s largest and most profitable toll-road operator. He deals with problems of the kind that could drive most people around the bend.

Consider, for instance, the episode this July when the Maharashtra Navnirman Sena (MNS), one of Maharashtra’s most raucous political parties, thought up an idea: Galvanise supporters to go past toll booths across the state without paying to use the roads. Egged on by exhortations made by their leader Raj Thackeray, they complied, and men tolling the booths could do nothing. Thackeray claimed it was to protest against the obscene profits the “toll mafia” was raking in from the dense traffic that used these roads.

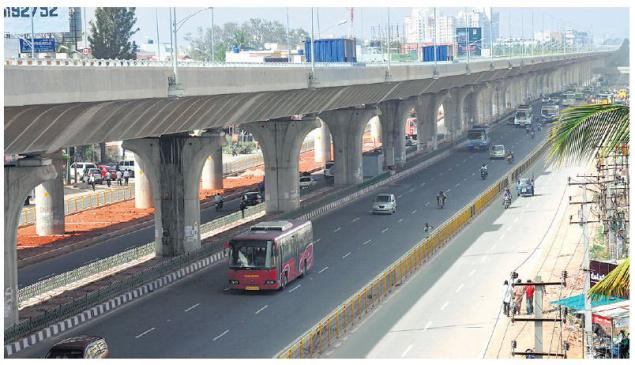

Toll booth staff manning the Mumbai-Pune Expressway, the crown jewel in IRB Infrastructure’s portfolio, came in for special treatment. (The company is responsible for its upkeep until 2019.) Ironically, Mhaiskar says, “Raj is a friend at a personal level.” But that said, he argues, “To those who say traffic has grown more than projected, I ask, what if it had been otherwise? Would we get our money back?”

I ask if he has tried explaining this to Mr Thackeray and how they continue to be friends. “Enforcing agreements signed with developers, and explaining the rationale to stakeholders is the government’s job,’’ he says, as a matter of fact. I can’t help but think it ironical. But I guess there is a method to the irony.

How else could he have grown the company into India’s largest in the sector, and manage 12 roads across west and south India? So, I probe him a bit deeper. “The government’s policy on road construction and toll through the build-operate-transfer (BOT) model has been the most successful and transparent of all public-private partnerships in the country. But it is also the most poorly understood,” he says.

The problem, Mhaiskar says, is no politician or bureaucrat has bothered to explain to the public how it works. By way of explanation, he offers an analogy. “If you borrow Rs 70 lakh to buy a home, and agree to repay it over 15 years, you return several times the amount to the bank by the end of the tenure, and nobody complains. Going by that same logic, how can you argue if a road developer has invested Rs 1,500 crore [over 20 years], returns ought to be limited to the original investment? What about our borrowing cost, maintenance costs and our returns?”

That is why, he says, public anger manufactured against toll-road operators by politicians have badly impacted investors in the business. Caught between policy changes and the unwillingness (or inability) of users to pay, they are stuck with millions of dollars in debt.

For instance, he’s still trying to extricate himself from a situation in Kolhapur, where IRB won a 30-year contract in 2008 to maintain all of the city’s inner roads. Back then, it was hailed as a pilot project that would lead the way for municipalities across the country to liberate themselves from the responsibility of maintaining roads.

People in the city, though, simply refused to pay, and earlier, in January, they organised rallies to protest against the tolls. Collections had to be stopped after the state government thought the protests impossible to ignore. All attempts to find a solution continue to hang in abeyance.

Problems like these find participants in the Indian infrastructure business under huge amounts of debt, and are compelling many to get out of the projects they had bid for. Mhaiskar, though, seems the rare animal with enough cash on hand. His revenues almost doubled from Rs 1,753 crore in 2009-10 to Rs 3,255 crore in 2011-12. His profit margins are a little over 15 percent. And, early in October, he signed on to buy out MVR Infra’s road project in Andhra Pradesh for an undisclosed amount. “A lot of such projects are now on sale, mostly by promoters under stress. We are looking at those that can give us an internal rate of return [IRR] of at least 20 percent,” Mhaiskar says.

You must be wondering if Mhaiskar is counting his chickens before they hatch, but Parikshit Kandpal, a senior analyst at Karvy Insitutional Equities, shares his optimism and is putting a ‘buy’ rating on the stock.

Most of the projects IRB is involved with are either in the west or south of India, he says. These are parts of the country that have demonstrated most growth. Of these, projects in Maharashtra and Gujarat account for 74 percent of IRB’s portfolio. “Understanding risks in traffic growth is a big part of our project evaluation,” says Mhaiskar.

When the government opened up projects for private participation in the late 1990s, many businessmen bid aggressively. They followed up later by raising equity from the public at super-normal valuations. Mhaiskar, too, capitalised on the market’s appetite for infrastructure companies. He raised Rs 944 crore through an initial public offering (IPO) in 2008.

For many, fat order books were a measure of success, irrespective of the cost at which they were acquired. But soon the regulatory environment changed, and returns from ventures dropped below expectations. As banks cut down on lending, larger companies like GMR declared they were taking ‘investment holidays’.

source: http://www.moneycontrol.com

Looking to involve people in infra development

December 10, 2012

December 6, 2012: The three-day ‘Infrastructure Conference 2012’ being organised by the Kerala Public Works Department is under way at the Bolghatty Palace in Kochi from Thursday.

The timing could not have been more apt coming as it does exactly a year after the previous event, which affords an opportunity for serious reflection and productive planning.

‘WORKING’ MINISTER

V. Ebrahim Kunju, who has already made a mark as a ‘working’ minister for public works, says that a number of suggestions/recommendations made at last conference are currently being implemented. One instance is where the department is moving ahead with a plan to laying concrete roads in the State on a pilot basis.

“It is not as if we are suggesting something that is not known to the State already; in fact, we used to have concrete roads here in the past,” the minister says. “It is just an issue of revisiting the past purely for reasons of advisability and practicality.”

He points to major metropolises such as Mumbai which have plumped for concretised roads with a comparatively longer life span. So public works department is essentially dusting up the concept here and proposes to implement same in Kochi – from HMT Junction in Kalamassery to Manalimukku in Kochi.

On another front, the public works department is looking at ways to ensure people’s participation in infrastructure development.

LOCAL BODIES

This is sought to be achieved through the vehicle of local self-government institutions after suggestions to the effect were floated at the Emerging Kerala Global Connect meet that Kochi hosted in September last and also in view of increasing opposition to land acquisition, the minister says.

So, the department is seeking to suitably tweak the public-private partnership (PPP) mode to public-private-people-partnership (PPPP) mode, Ebrahim Kunju says. The department believes that many of the imponderables to development issues, including vexed land acquisition, could be more effectively dealt with in this manner.

An exclusive session has been earmarked to discuss this issue at the Infrastructure Conference 2012, the minister said. The main theme, ‘An integrated approach to infrastructure development,’ has been carefully chosen to rhyme with the comprehensive revamp that the department is currently undergoing with a view to assimilating technological and conceptual advancements.

BUILDING ON 2011

According to the minister, the last edition of the conference helped the department to adopt latest technologies, construction techniques, and management systems for sustainable development.

He attributed various path-breaking initiatives launched since – concretising roads, revising the public works department manual, launch of e-tendering, and inclusion of road safety and maintenance aspects in the contract terms on a long-term – to the successful conclusion of the year 2011 event and the result-oriented follow-up thereafter. The department officials may have just got another opportunity to acquaint themselves with modern techniques and approaches in the infrastructure and construction sectors, Ebrahim Kunju points out.

The public works department manual has been revised after a long gap of 40 years. E-tendering and e-payment options will improve transparency and efficiency of the tendering transactions and also speed up connected procedures.

PERFORMANCE GUARANTEE

Despite spending huge amount of money for maintenance, the roads in the State are in a state of disrepair, not to speak of despair, the minister says. It is with an intention to meet this situation fair and square that the State Government has proposed to implement a performance-based guarantee in the road building sector.

According to the minister, the State Government has envisaged five-year performance-based guarantee for all heavy maintenance works. As per this package, maintenance of roads for a period of five years after building them would have to be done by the contractor who undertakes the project. This would help in improving the quality of roads, Ebrahim Kunju says.

One other feature that the minister sought to proudly highlight is the fact that there is hardly any delay to speak of in work/projects. “Works are completed on time and sometimes even before time. Our hardworking and dedicated staff are committed to providing quality work and enhancing the comfort level of road users,” the minister said.

But he was aware of the major challenges that the department is faced with, not least of which is land acquisition and resettlement. But here again, the minister had reason to sound hopeful and optimistic. He agreed that there is apprehension in the minds of people in the State about land acquisition.

BEST PACKAGE

“But I’m happy and proud to say that, among the States, we offer the best rehabilitation and resettlement package. Those who sacrifice land for public good – for construction purposes in this case – will get market value for the parcel parted with. No other State in the country has anything better to offer,” Ebrahim Kunju says.

District level purchase committees with collector as the chairman will decide on the amount to be compensated and the recommendation is escalated to an empowered committee. The latter will have the final say on the amount payable, which would be paid out to the concerned person. According to the minister, rehabilitation packages have been designed for shopkeepers and street vendors, who will be given six months income as compensation without delay.

The minister was equally forthcoming on the issue of sustainable development, which is something close to his heart. Since sustainable construction is the running theme of the times we are in and gaining more and more prominence, the State Government has endeavoured to promote green building concepts and practices in a planned manner. Being an environmentally sensitive geographic region with meagre resources, it is desirable and only in the fitness of overall scheme of things that the State should promote green building technology in a systematic manner.

SUSTAINABLE GROWTH

While energy performance of the building is the primary focus in the green-building context, water conservation and use of sustainable materials also need most attention considering the peculiar characteristics of our State. Public works department buildings will play an important role by demonstrating this commitment by fully adopting the green building in all new buildings, the minister avers.

Meanwhile, timing of Infrastructure Conference 2012 assumes significance viewed against the backdrop of the multiple challenges that the road sector in the country at large has continued to face in recent times. These range from high interest rates, reduced availability of funds and execution slowdown to increased competitive intensity, according to an assessment by rating agency, ICRA.

Award of new projects has picked up during the last two quarters with the National Highways Authority of India awarding some mega projects.

However, execution on many of the projects awarded over the last one year has remained slow primarily because of delays in land acquisition, clearances, and financial closure. Projects that had the requisite approvals and funding reported healthy execution.

ROUGH PHASE

While both developers and contractors are going through a rough phase over the last one and a half years, the challenges were higher in the case of companies that had recently entered the project development space. While developers with a portfolio of operational toll road projects were partly hedged from high interest rates due to inflation-linked toll rates, those with projects in the developmental phase faced challenges in achieving financial closure due to weakened project viability owing to high interest rates besides delays in land acquisition and approvals.

Road construction companies continued to face long working capital cycles, which put a strain on their liquidity position and increased their indebtedness. The operating margins of several road contractors also witnessed pressure because of rising commodity prices (for fixed-price contracts) and idling of capacities as execution could not begin in many new projects.

With the National Highways Authority increasingly awarding projects under the public-private partnership model, engineering, procurement and construction (EPC) contractors have struggled to maintain their order-book growth and many have chosen to enter the PPP space by undertaking projects on build-operate-transfer basis.

The equity requirement for BOT projects, along with the weak capital markets that have made raising capital difficult, has increased their dependence on external borrowings. Further, many of these companies have raised debt at the parent or holding company level to meet the equity requirement in BOT projects thus significantly increasing the indebtedness at the group level.

9 sessions proposed

Infrastructure Conference 2012 has been structured to host nine technical sessions where experts of renown would share their experience.

Apart from Ministers, bureaucrats, engineers, and domain experts would attend the meet. Among the topics being discussed are institutional preparedness for a paradigm shift; new dimensions in land acquisition; asset management with special emphasis on performance-based maintenance approach; and pre-fabrication technology in modern construction.

Multi-modal integration of transport systems, road safety issues, participatory approach, and innovative financing for infrastructure development would also come up for discussions.

‘Vox populi,’ a special session, with an open debate on national highway development under build-operate-transfer (BOT) and road safety rules and a presentation on development of monorail projects would also be organised.

Among those who would be making special addresses are K. M. Mani, Minister for Finance; Aryaden Muhammed, Minister for Transport and Power; P.J. Joseph, Minister for Water Resources; K.C. Joseph, Minister for Rural Development; and Manjalamkuzhi Ali, Minister for Urban Development.

After the felicitation addresses, Parveen Kumar, Senior Vice-President, IL&FS Rail Ltd, will make a presentation on monorail projects.

The post-lunch session will be chaired by Manoj Joshi, Joint Secretary, Government of India, who will make the introductory address.

Arnab Bandyopadhyay, Senior Transport Engineer, World Bank, will present the paper on ‘Institutional preparedness – Need for paradigm shift.’

This will be followed by a panel discussion. Later, S.V.R. Srinivasan, additional metropolitan commissioner and managing director, Mumbai Metro, will make a presentation.

The topic will be on ‘New dimensions in land acquisition – A participatory approach.’ Ajith B. Patil, secretary, Kochi Corporation, will join him.

This will be followed by ‘Vox Populi,’ an open debate on national highway under BOT (build, own, transfer) and road safety issues.

source: http://www.thehindubusinessline.com

India GRI Report 2012

November 26, 2012

[nggallery id=9]

Infrastructure companies going slow on highway projects

September 13, 2012

Faced with a tough business environment, infrastructure and construction companies are treading cautiously on tollways and build, operate and transfer mode (BOT) PPP projects of the National Highway Authority of India (NHAI).

They now prefer the engineering, procurement and construction (EPC) mode projects .

IVRCL on Monday indicated that it has decided to take a holiday from bidding for BOT projects to focus on EPC. This is not an isolated case; most infrastructure companies are in a pause mode re-strategising looking at EPC projects.

Interaction with leading infra sector firms shows that they are all faced with difficulties of high interest costs, challenges of achieving financial closure, as banks and lenders have hit sectoral cap, and have been demanding more equity in a market where equity is hard to come by.

M. Gautham Reddy, Executive Director of Ramky Infra, said the number of projects that have come up for participation are less and companies have become extra cautious, given the market conditions. They are looking at the opportunity to take up EPC mode projects where NHAI will pump in funds.

The Chief Financial Officer of Madhucon Projects, S. Vaikuntanathan, said most companies enjoy being EPC contractors, but NHAI wanted BOT projects, forcing developers to take to them.

“Developers are facing difficulties in meeting the equity requirements for BOT projects as equity markets have dried up and foreign investors are wary to come in. Most developers want to exit, making it a tough situation,” Vaikuntanathan said.

Madhucon has nine road projects with four being operational, three under development, and two close to financial closure.

T. Adi Babu, Chief Operating Officer, Finance, Lanco Infratech, said with lenders demanding higher equity participation up from 25 to even 40 per cent, difficulties in securing right of way and local implementation issues, are all creating problems for developers.

AGGRESSIVE BIDDING

“The aggressive bidding in the past by some companies is also taking a toll. All projects are not like the Gurgaon highway,” he felt.

R. Balarami Reddy, Executive Director Finance, said the traffic projections are often high and this causes unexpected expectation from developers. This is also one of the reason why NHAI needs to look at PPP mode projects closely and restructure contracts.

An independent regulator would help.

SOURCE: http://www.thehindubusinessline.com

Government approves road projects of Rs 5,388 crore in three states

January 16, 2012

NEW DELHI: The government on Thursday approved three road projects in the states of Himachal Pradesh, Haryana and Andhra Pradesh entailing a total investment of Rs 5,388.36 crore.

The Cabinet Committee on Infrastructure cleared widening of Kiratpur-Ner Chowk section in Himachal Pradesh at a cost of Rs 2,356.20 crore, six-laning of Vijaywada -Gundugolanu section in Andhra Pradesh worth Rs 2,011 crore and Rs 1,021.16 crore scheme for four-laning of Uttar Pradesh/Haryana border- Panchkula section in Haryana.

“The main objective of the project is to expedite the improvement of infrastructure in Himachal Pradesh and also in reducing the time and cost of travel for traffic, particularly heavy traffic, plying between Kiratpur and Ner Chowk,” an official statment said about the Himanchal Pradesh project.

The widening of 84.38 km stretch on National Highway (NH) 21 in state will be implemented under NHDP phase III on design, build, finance, operate and transfer (DBFOT) basis in BOT toll mode of delivery, it said adding of the entire cost, Rs 537.37 crore will be spent on land acquisition, rehabilitation, etc.

The project, on completion, will reduce the time and cost of travel for traffic, particularly heavy traffic, plying between Kiratpur and Ner Chowk. It will also increase the employment potential for the local labourers for the project.

NH 21 is not only an important link connecting national capital and tourist destination of Manali in Himachal Pradesh but is a major link to Leh in Ladakh.

About Andhra Pradesh project comprising 103.59 km, the statement said it will be implemented under NHDP Phase V on DBFOT basis in BOT (Toll) mode of delivery.

“The total project cost estimated will be Rs 2,011 crore out of which Rs 327 crore will be for the land acquisition, rehabilitation, resettlement and pre-construction,” it said.

It added, “The main objective of the project is to … increase the capacity of Golden Quadrilateral (GQ) corridor and also to reduce the time and cost of travel for traffic, particularly heavy traffic between Vijayawada- Gundugalanu.”

NH 5 is an important link connecting Kolkata to Chennai, which is part of the GQ Corridor. This will facilitate road users, particularly traffic on Chennai-Kolkata section of GQ passing through Guntur, Krishna and West Godavari districts and Chennai- Hyderabad and Kolkata – Hyderabad sections.

Out of the total cost of the 104.7-km Haryana project on NH 73 under NHDP Phase-III on DBFOT basis in BOT (Toll) mode, Rs 86.23 crore will be for land acquisition, rehabilitation, resettlement and pre-construction.

The project, on completion, will reduce the time and cost of travel for traffic, particularly heavy traffic, plying between UP/Haryana border – Yamunanagar – Saha – Bawala – Panchkula. It will also increase the employment potential for the local labourers for the project activities.

Source: articles.economictimes.indiatimes.com

Annual National Conference on Road Infrastructure in India 2011

December 28, 2011

[nggallery id=5]

Dear Reader

Indian tollways team is glad to share the moments of conference which was successfully conducted by Annual National Conference on Road Infrastructure in India 2011 on 6th Dec 2011 at Mumbai. 14 speakers and about 100 delegates were presented in the conference.

Theme of the conference was Planning, Designing, Modernization & Investment for Indian Roads to match International standards.

Confirm speakers for the conference were:

- Shri Nitin R.Gokarn, Joint Secretary, Ministry of Road Transport & Highways

- Mr. Sudhir Hosingh, CEO-Roads, Reliance Infrastructure Limited

- Prof M.N.Sree Hari, Advisor to Gov. Karnataka T.T & Infrastructure

- Mr. Satish Pendse, President – Highbar Technologies Limited -Hindustan Construction Company

- Mr. Alon Globus, Director, i-Tec-India

- Mr. N.K.Sinha, Chairman International Road federation Indian Chapter

- Shri Sudhir Thakre, Secretary, PMGSY

- Shri Ajay Saxsena, PPP Expert, Asian Development Bank (ADB)

- Mr. N.N.Kumar, Dy. Chairman, JNPT

- Mr. Rajesh Rohatgi, Sr. Transport Specialist, World Bank

- Mr. Brijesh Koshal, MD, Daiwa Capital Market

- Mr. Kamal Bali, President & CEO, LeeBoy India Construction Equipment (P) Ltd

- Mr. Sachin Bhatia, CEO, Metro Infrasys p Ltd.

- Ms. Archana, Prof. RV College of Engineering

- Dr. S. L Dhingra, Chair Professor, IIT Mumbai etc.

Presentation By Mr. A.V.Sinha on The Way Forward in Highway Sector

Presentation by Mr. Suresh Ramchandrani on MSRDC Role

Presentation By Mr. P.Y.Deshmukh on SPV Projects for Port & Rail Connectivity

Presentatin by Mr. Rajesh Rohatgi on OPRC – RR

Presentation by Mr. Sachin Bhatia on ETC in India

Presentation by Mr. Vivek Singh on Towards a Sustainable Logistics Network in India

Cabinet Committee on Infrastructure okays 15 highway projects

November 21, 2011

The Cabinet Committee on Infrastructure approved 15 projects for highway construction of about 1,814 kilometres at an estimated cost of Rs 15,680 crore.

The National Highway Authority Of India (NHAI) will undertake 10 projects whereas implementation of the rest of the projects would be with the Rajasthan and Madhya Pradesh state agencies.

Source: articles.economictimes.indiatimes.com

Annual National Conference on Road Infrastructure in India 2011

November 10, 2011

The theme of the conference is Planning, Designing, Modernization & Investment for Indian Roads to match International standards.

Updated program and more details or logon to http://ibkmedia.com/events/index.php?event_id=3

The Road Infrastructure In India 2011 conference provides an excellent platform for decision makers from the government and service/technology providers to come and interact. The conference through its technical sessions will discuss and deliberate the key issues in the Indian Road sector:

Topics

- Challenges in land acquisition for road construction in India

- Challenges in Public Private Participation (PPP) – Build Operate and Transfer (BOT) toll mode or BOT (Annuity) mode

- Current Scenario on Roads in Karnataka State (State Initiatives in PPP)

- Output and Performance Based Road Contracts – An alternate PPP Contracting Model

- Challenges to build 20 km of road per day under the five year plan (2017-22)

- Advance Technology Electronic Toll Collection (ETC)

- Role of IT in Road Construction

- Traffic Management by Designing of roads, Flyovers

- Updates on NHDP-iv, or NHAI

- Opportunities & Challenge PMGSY in Next 3-4 year’s

- PPP of Special Purpose Vehicle (SPV) Projects for Port & rail Connectivity

- Challenges in Achieving high Return on Investment (ROI) through PPP

- New technology & Equipments for road Construction

- Ecological Road construction

- Challenges in construction and maintenance of roads in India

- Challenges for Sustainable Rural Road Development

Confirm speakers for the conference

- Shri Nitin R.Gokarn, Joint Secretary, Ministry of Road Transport & Highways

- Mr. Sudhir Hosingh, CEO-Roads, Reliance Infrastructure Limited

- Prof M.N.Sree Hari, Advisor to Gov. Karnataka T.T & Infrastructure

- Mr. Satish Pendse, President – Highbar Technologies Limited -Hindustan Construction Company

- Mr. Alon Globus, Director, i-Tec-India

- Mr. N.K.Sinha, Chairman International Road federation Indian Chapter

- Shri Sudhir Thakre, Secretary, PMGSY

- Shri Ajay Saxsena, PPP Expert, Asian Development Bank (ADB)

- Mr. N.N.Kumar, Dy. Chairman, JNPT

- Mr. Rajesh Rohatgi, Sr. Transport Specialist, World Bank

- Mr. Brijesh Koshal, MD, Daiwa Capital Market

- Mr. Kamal Bali, President & CEO, LeeBoy India Construction Equipment (P) Ltd

- Mr. Sachin Bhatia, CEO, Metro Infrasys p Ltd.

- Ms. Archana, Prof. RV College of Engineering

- Dr. S. L Dhingra, Chair Professor, IIT Mumbai etc.

Date & Venue for Road Infrastructure In India 2011 Conference

Day: Tuesday, 06th December 2011

Timings: 9.30 AM onwards

Venue : Hotel, JW Marriott Juhu Tara Road Mumbai

In addition to the above around 150 high profile delegates comprising decision makers from central, state governments and Private professionals, consultants, Road Developers, national & international funding organizations, Technology & Equipment suppliers, Contractors, service providers, research & academic institutes will discuss, deliberate and share their knowledge and experiences.

For more Information, You can email to [email protected]

We are sure that the participation of delegates from your organization will not only update them on the current issues, emerging business opportunities in Road Sector in India but also provide them the ample opportunities to meet with the national and international experts to discuss, share and learn from their the experiences.

Looking forward to receive you at the Road Infrastructure In India 2011 conference.

Source: http://ibkmedia.com

The construction sector is besieged with hurdles that are hampering growth.

October 3, 2011

India’s construction story has great relevance at a time when most metros have lesser space for development and a large number of people from tier-II and tier-III cities are flocking to the cities, which has put enormous strain on the infrastructure in metros. However, for companies in the construction sector, this has resulted in stiff competition, thus bringing down the Internal Rate of Returns of most of their projects.

The construction sector has been in the news of late. Firstly, increasing interest rates has ensured that it is a topic of discussion among the general public and secondly, delays in rolling I out of projects by the government has been a cause of concern for construction companies in the last few months. These have resulted in the downgrading of a number companies in the sector.

So what exactly are the problems that are posing hurdles for the sector’s growth? At a time when interest rates are rising and companies are in the cost-cutting phase, would construction companies be able to find a firm footing in the coming quarters? We give you a lowdown on the opportunities in the construction sector and the problems that are making it difficult for construction companies to turn these opportunities into visible earnings.

THE INDUSTRY

The construction industry is directly related to the infrastructure of the government and corporations in different sectors. It is estimated that under the 11th Five-Year Plan (FY08-12) around Rs.11 trillion has been spent on infrastructure.

Of the total estimated amount of Rs.20 trillion, Rs.9 trillion is to be spent in FY12. Apart from this, the 12th Five-Year Plan is expected to entail an investment of Rs.41 trillion in infrastructure projects, which means the investment allocated to this sector is over 200% in comparison with the previous Five-Year Plan.

In addition to this, other sectors such as power, road, irrigation, port, airports and water infrastructure depend heavily on construction companies as enablers of growth. In the coming two fiscal years, these sectors are likely to present enough order book and earnings visibility for the construction companies.

a) Power Sector

Experts believe that if the government follows the investment pattern of the Eleventh Plan, a substantial amount of investment would be channelized into power generation, transmission and distribution segments of the power sector in the Twelfth Plan. After providing for investment in these sectors, the remaining investment would find its way into roads, irrigation as well as water supply and sanitation.

In addition to this, India’s power capacity is expected to treble in the Eleventh Five-Year Plan. In comparison to the Tenth Five-Year Plan of adding capacity of 12 GW of thermal power, it is expected that the Eleventh Five-Year Plan would add a capacity of 50 GW.

Additionally, private players in the sector too would play a crucial role in it and is estimated to account for 56% of 27 GW supposed to be added in FY12. Hence, there is enough opportunity for construction companies that would be building power plants to meet the power demand in the country. The estimated opportunity for the construction companies would be worth $56 billion or Rs.254 crore, approximately. The Power Grid Corporation of India, which is the central nodal agency for maintaining national and regional transmission grids, has a capital expenditure of Rs.550 billion, which it would spend in the span of four years ending 2012.

b) Roads

Roads form an integral part of the order book of construction companies. Being a developing country, infrastructurally speaking, roads in the country are in a bad state and suffer from under capacity.

The government has come up with programmes such as the National Highway Development Project (NHDP) and the Pradhan Mantri Gram Sadak Yojna (PMGSY) to upgrade the national highway network and the rural road infrastructure, respectively. Projects have also been undertaken at the state level to upgrade state highways. Multi-lateral agencies like the World Bank and the Asian Development Bank have been involved in funding a number of projects at every level.

Under NHDP, the government has planned to develop 49,987 km of national highways. Projects like the Golden Quadrilateral and the North-South/East-West corridors are almost complete. However, projects whose cumulative length adds up to more than half of the total length to be developed under the NHDP, are yet to be awarded. Estimated projects worth $55 billion are yet to be awarded and may be issued in FY11-14 if NHDP is to be completed by its deadline.

c) Water Infrastructure

Water infrastructure is in dire need of investments. There is a scarcity of fresh water in India. Nearly 85% of water in the country is used for irrigation. Every year some regions of the country face drought, while others face floods. Scanty rainfall received last year and the spate of farmer suicides in recent years have brought the government’s attention to the development of water resources and channelize the supply to every corner of the country.

The government has set aside nearly Rs.415 billion for water projects. This forms about 71% of the total allocation under the Jawaharlal Nehru National Urban Renewal Mission (JNNURM). The projects under JNNURM are meant to establish and upgrade infrastructure in cities with water supply, sewerage and drainage being the top priority. Providing clean drinking water and treating and disposing sewage are the main objectives of the programme. Hence, these projects provide enough opportunities for the construction companies to cash on.

ISSUES

However, there are several roadblocks obstructing the growth of construction companies. The construction companies are finding it difficult to secure consistent orders. There have been delays due to lack of clarity on land acquisition, fuel linkages, and financing. Also, projects are getting unviable due to outdated costs and insufficient manpower. Another important reason for delays is regulatory norms on the part of the government, which is probing a host of scams. These obstacles have stalled swift issuance of projects and, hence, increased interest cost of companies.

Construction companies are also facing a problem of increase in working capital cycle. A working capital cycle is defined as the number of days taken by a company to procure revenues for its projects. The working capital cycle of construction companies has widened in the past few years due to issues such as credit crunch in FY09, delay in payments, slippages in execution of projects and change in mix of projects.

The working capital cycle for companies has increased from 85 days to 145 days. This deterioration in the last two quarters is mainly due to delays in payments and increasing loans and advances.

This has resulted in higher borrowing, thus impacting profitability. Most companies’ loans and advances shot up because of increasing loans to their subsidiaries for investments in BOT projects, which will be returned once the projects become operational.

As a result of increasing working capital cycle of construction companies, the debts on their books have been rising. Most construction companies still maintain a debt to equity ratio of less than 1. However, with high working capital these companies have to stretch their balance sheet to fund future growth. More so with rising interest rates, the resultant increase in cost of funds would hurt profitability of companies. Also, execution of projects in the last two quarters has slowed down. Much of the negative impact of these factors can be seen in the lackluster performance of most construction companies in the sector in the June ’11 quarter.

Going forward, it is important that the government clears projects promptly and urgently. Traditionally, the third and fourth quarters of a fiscal are considered to be better than the first and the second quarter.

Experts believe that it would take few more quarters for the sector to enjoy the desired momentum in project execution considering inflationary and interest rate concerns. However, most big-sized companies are likely to see revenues coming in the next three to four years.

Source: stockmarketsreview.com

Supreme Infrastructure: Concrete structure

August 23, 2011

The company, which is present in railways, bridges, buildings, power, sewerage, irrigation and roads, is looking to expand its capabilities in marine projects and deepen vertical strength in various states

Supreme Infrastructure India (SIIL) is one of the few listed infrastructure companies that is doing extremely well. SIIL is present in seven verticals—railways, bridges, buildings, power, sewerage, irrigation and roads—across Maharashtra, Haryana, Punjab, Rajasthan, Uttar Pradesh and West Bengal. Each vertical functions as a business unit, thus increasing focus on execution as well as order book growth. SIIL started with executing orders of Mumbai’s municipal corporation and the public works department of Maharashtra and, when the infrastructure boom started in India in the mid-1990s, it expanded its activities by procuring contracts of urban development and municipal authorities in various cities.

SIIL’s construction business has an integrated business model with in-house asphalt, ready-mix concrete, crusher and wet-mix plants, ensuring timely supply of construction material and saving of tariffs & taxes due to captive material transfers. This also ensures lower costs.

For the financial year ended 31 March 2011, SIIL’s total income jumped 72% to Rs918.70 crore from Rs534.10 crore, while net profit surged by 91% to Rs74.80 crore from Rs39.20 crore in FY09-10. Its net profit for the March 2011 quarter zoomed 148% to Rs27.40 crore from Rs11 crore in the corresponding period last year on an 88% rise in total income to Rs328 crore from Rs174.30 crore.

At present, SIIL has five BOT (build, operate, transfer) projects in Maharashtra. These include Kasheli Bridge which is expected to be complete by Q2FY11-12, while the Panvel-Indapur and Manor-Wada-Bhiwandi projects are expected to be completed by July 2013 and the Ahmednagar-Karnala-Tembhurni project is expected to finish by March 2014. The Haji Malang project is a ropeway project having a construction period of two years. The Manor-Wada-Bhiwandi project—an industrial belt connecting Gujarat and Maharashtra—is the company’s first BOT road project.

The company has also won contracts in the irrigation, railways, building and power sectors. Its Osmanabad (Andhra Pradesh) irrigation project is scheduled to be completed by June 2012. SIIL, in a joint venture with Patwari Electricals, is executing turnkey power projects for Maharashtra State Electricity Distribution Co Ltd. In the railways segment, SIIL has won many orders from Mumbai Railway Vikas Corporation. Also, in the building segment, the company has won several orders from government agencies as well as private companies. Some of the major projects include construction of Edge Towers worth Rs255 crore at Ramprastha City, Gurgaon, construction of Hexcity worth Rs138 crore for Armstrong group at Navi Mumbai.

The company is looking to expand its capabilities in the marine projects segment and deepening vertical strength in each state. In Kolkata, it has joined hands with Bengal Tools to undertake orders in the industrial infrastructure space.

However, currently, most of the company’s orders are from Maharashtra (around 76%). Any slowdown in the order book from this state may affect the cash flows of the company. SIIL has a track record of timely completion of projects. But, being a new player in the BOT segment, there could be a potential execution risk. Land acquisition is also another problem—any delay in project execution would affect the revenues of the company, going forward.

Over the past five quarters, SIIL has reported an average growth in revenues and operating profit of 59% and 56%, respectively. Its average operating margin is 17% and return on net worth is 29%. Its market-cap to revenues is 0.33, while its market-cap to operating profit is 2.16 times. The stock is an attractive buy at the current market price.

Source: moneylife.in