Healthy start for UPI as banks open Virtual Payments Addresses at brisk pace

October 4, 2016

The ambitious Unified Payments Interface (UPI) platform that was launched by National Payments Corporation (NPCI) last month has got off to a brisk start with banks’ customers having started opening their virtual payment addresses at a fairly rapid pace. With this system, customers have to open a virtual payments address of their choice and link it to any bank account. The VPA acts as their financial address and users need not remember the beneficiary’s account number, IFSC codes or net banking user id/passwords for sending or receiving money. The VPA acts as a financial address for a user in lieu of their 16-digit bank account number and the 11-digit IFSC code.

ICICI Bank, the country’s largest private sector bank, said it has crossed the milestone of 1 lakh Virtual Payment Addresses (VPA) on ‘Unified Payments Interface’ (UPI) within three weeks of its launch. With this, customers of any bank who have created their VPA on ‘Pockets’ as well as ICICI Bank customers using ‘iMobile’ can soon pay using their smartphones at over 6,500 Hindustan Petroleum Corporation Limited (HPCL) petrol pumps and more than 2,000 stores of Aditya Birla Fashion and Retail Limited (ABFRL) across the country. The bank has tied up with ABFRL and HPCL to offer UPI-based payments at its retail outlets.

“I’m delighted to share that ICICI Bank has crossed the milestone of creating 1 lakh VPAs for enabling UPI based payments, within three weeks of its launch. We have received an encouraging response from users including non-ICICI Bank customers for creating their VPA using ‘Pockets,” Chanda Kochhar, MD & CEO, ICICI Bank said. She also said ICICI Bank intends to continue exploring more such potential partnerships (like HPCL ABFRL) which will go a long way in popularising the usage of UPI. “I believe that UPI will revolutionise the landscape of electronic payments in India and go a long way in reducing the usage of cash in the economy,” she added.

A. P. Hota, MD & CEO, NPCI lauded ICICI Bank’s effort and said the lender was among the frontrunners to launch UPI through the app. “Transactions on a real-time basis via mobile app has not been made possible anywhere else in the world. Considering the ease of transactions offered by UPI, in the days to come more customers will get accustomed to UPI based transactions,” Mr Hota said.

The upgraded ‘iMobile’ application of ICICI Bank comprising UPI services is available on the smartphones with Android and iOS operating systems.

YES TAG gains momentum as it crosses 10,000 transactions

October 4, 2016

YES TAG – a Chatbot-based banking app from private sector lender YES Bank is gaining momentum as it has crossed a major milestone of 10,000 transactions. The application enables users to carry on seamless chat banking on five messaging platforms, namely, Facebook Messenger, Twitter, Skype, Telegram and WeChat. In other words, YES Bank customers can do a banking transaction or make an enquiry while chatting with their friends or relatives.

YES TAG app enables the chat bot to perform easy, anywhere and anytime banking. For instance, users can simply launch Facebook Messenger app from YES TAG and send ‘BAL’ to the YES BANK bot to know their account balance. Customers can also check their recent transactions, do a fixed deposit enquiry, request a cheque book and much more. The Chatbot-based YES TAG can even transfer funds instantly to registered beneficiaries.

The unique benefit of this bot is that the user does not need to open or login into a separate app for carrying out banking transactions. YES TAG enables users to access banking service from any of the five chat platforms – be it while chatting with friend(s) on Facebook Messenger or tweeting on Twitter; or even while on a Skype call with a distant relative!

“We want to give our customers a personal concierge that gets all banking tasks done. YES TAG’s smart bot will soon recharge customers’ mobile/DTH, hot-list cards, register for e-statements, and even pay their bills,” said Ritesh Pai, Senior President & Country Head, Digital Banking, YES Bank.

The lender is also working on developing advanced artificial intelligence and multi-lingual profficiencies for these services. The bank is set to enhance capabilities of its chatbot to lead customers all the way to the nearest YES Bank branch or ATM should they need assistance, even after befriending this intelligent bot on the app-store.

The Internet of Office

October 3, 2016

Smartphones, smartwatches, smart glasses: we are surrounded by intelligent, data-driven technology aimed at optimizing every area of our lives.

Yet a gadget is just the beginning of this expansive, sometimes complex relationship. Its real potential lies in the network of relationships that emerge among these devices. Connected, smart devices and their attendant applications represent the next big leap in human-computer interaction: the intelligent workplace.

What is the intelligent workplace?

For a moment contemplate the role of your Smartphone in your average workday. It is your portable office — you can check email, edit documents, and monitor performance from anywhere. Beyond those basic functions, a host of applications have surfaced to meet certain professional needs. Smart devices enable you to crowdsource important information in real time, get directions to your next meeting straight from your smartwatch, or receive a notification that you’ve exceeded your budget limit for the ongoing month. In effect, the infrastructure of the smart office — smartphones, wearables, and applications — is already in place. All that’s missing is the foundation to bring it all together.

It is here that businesses have a unique advantage. Companies, like salesforce.com, have started creating products that span multiple devices and provide a platform for building custom apps that integrate existing products and services.

So what will the smart office look like? Let’s take a look at four key areas.

Collective intelligence

Imagine having access to your entire organization to answer a customer question or give feedback on a new marketing idea. While two heads are better than one, 100 heads working together can change the world. Connecting people across your company enhances accuracy and productivity. If a social media manager gets a question about her product’s API, she no longer has to fumble for a documentation page; instead, she can reach out to the product team (via Chatter, in some cases) for an answer within minutes. You can connect the right person, at the right time, no matter where you are.

Connected products

In the past, the first sign of trouble came when a product broke down; today, each component of a smart device can monitor its condition and alert technicians when service is required. Connected products can also offer unprecedented insight. Disneyland is replacing traditional tickets with MagicBands, smart bracelets that serve as a visitor’s ticket and payment method while also tracking her spending habits, movement, and wait times for rides. Using this data, park managers can control traffic and develop targeted marketing campaigns.

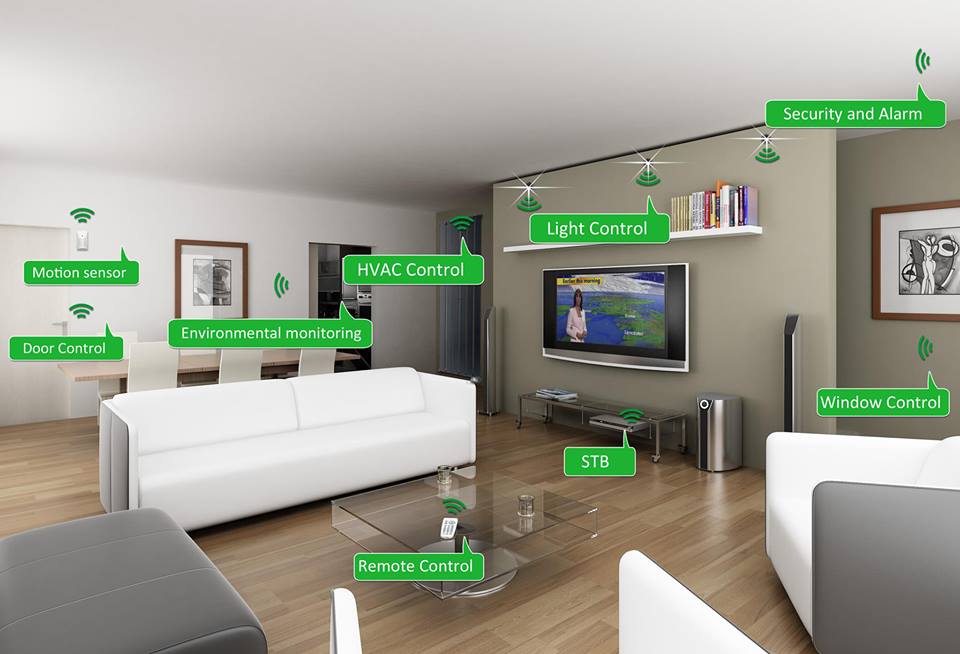

Connected environments

Devices like Philips’s hue light bulbs and Google’s Nest thermostat turn a smart office into an intelligent ecosystem. Office managers can crowdsource the optimal workplace temperature (imagine: no more fights about whether it’s too hot or too cold!) or notify a sales rep that his next appointment has arrived. Similarly, sales reps in the field can map nearby prospects and monitor recent activity on different accounts.

Business Intelligence

A smart workplace also helps make sense of broad swaths of data, presenting only the most pertinent and actionable insights to employees. When you open your business app on your mobile, you don’t see your entire calendar, just a list of the day’s events and tasks. When you research a prospect, you see her most recent activity rather than a flood of superfluous information. Your performance analytics are carefully curated and delivered to a dashboard at your phone. Instead of a burden, your data becomes a competitive edge.

As devices continue to connect us, we are becoming part of much more than an office. It’s time to start thinking strategically about how to bring your company and your workplace together for an unprecedented degree of sophistication and intelligence.

Leading the Smart way for Waste Management

October 3, 2016

Municipal solid waste (MSW) management is an area that needs attention, especially considering the Smart Cities Program. Meet Suhas Dixit, CMD, Pyrocrat Systems LLP, whose work at Navi Mumbai is surely a case study for all to emulate. Among the few companies in India that offer the patented pyrolysis technology that converts waste into energy, Pyrocrat is helping the city of Navi Mumbai to recycle 300 metric tonnes (about 50 truckloads) of waste. This is segregated and converted into compost, recyclables (plastic, metal, etc.), refuse-derived fuel (RDF) and inert gases. Dixit provides some insights.

What is the scope of your work in India?

We are a company that manages 300,000 tonnes of municipal solid waste per day. Unlike in developed countries where people segregate their wet waste from dry waste, in India, we put it all together. If you separate this waste, it can be recycled. Therefore, the first step required is segregation and we are a specialist at this since it is not segregated at the source. We then convert this into energy. We convert waste plastic and waste tyres into diesel. We are present in two sectors of waste management, namely, recycling and energy recovery. We see huge gaps in these areas as the energy recovery segment doesn’t even exist in India right now. What people do is, in case they cannot recycle the waste, they put it in landfills.

However, for a waste management project to be sustainable, it is not enough to think of the social aspects. Since not enough importance is given to economic viability, most waste management projects end up as failures. When you want to come up with a sustainable project for waste management, you have to think about three things – social appeal, environment compliance and economic viability. This is where organisations like us are specialized.

How big is the problem?

In developed countries, they recycle 80 per cent of the waste and not a great deal of wasteland gets generated. If you consider developing economies like India, South Africa and China, huge quantities of wastelands are created like ulcer patches on the earth. These patches release methane gas which is 10 times more potent than carbon dioxide. It is also the cause of the foul odour you associate with dumping yards. Around 5-10 per cent of global warming is happening because of methane coming out from dumping yards.

Specific to India, just for instance, in 2012, across the country, the number of oil barrels that went to landfills is 57 million barrels of oil, 9 million tonne of compost and 6 million tonne of recycled material. In India, around 1.3 per cent of its land is getting converted into wasteland every year. Around four-five years ago, we didn’t have the problem of finding space for landfills. Now, there is a shortage. What people are doing now is they have started stacking up the waste above each other. The height of landfill has now gone up to a height equivalent to the fourth and fifth floors of buildings.

What are the technologies to deal with this?

The key technologies for managing waste include composting where you convert a major part of the waste into compost. This compost can further be converted into fertilizers or can be used as compost, as it is. The second technology is refuse-derived fuel (RDF). We have this technology operational in Chandigarh. In Navi Mumbai, we use composting technology and in Chandigarh we use RDF. The third technology available is bio-methanation but this technology is risky.

How many companies are there in the country that does what you do?

We are the leaders for this in Asia. In the world, we rank about third or fourth. Nobody is near us. For instance, in the first technology, we are the only ones who have established a plant as an engineering company, and which is operational. Nobody does segregation and nobody does composting. Waste management up till now, was a huge model of corruption. However, with the new government in place and the Smart Cities mission, a lot of these tenders are beginning to come up for re-tendering. This shows that the focus is on actually finding the right companies for the job and the focus clearly seems to be on implementation.

Transnational highway to link India with Nepal, Bhutan & Bangladesh

October 3, 2016

Archetypal narrow and winding Himalayan roads like this one have been thoroughfares of trade for centuries.

In a move that could boost trade and commerce in the South Asian region, an ambitious project to link these countries through highways has been unveiled by the Indian government which the Manila-based Asian Development Bank has evinced interest to fund.

The Bangladesh-Bhutan-India-Nepal (BBIN) road initiative has been mooted by the finance ministry to improve ground connectivity in the region and the mandate is to complete the project in the next two years. The government has approved this highway construction and maintenance project, which is worth $ 1 billion, and Asian Development Bank has been roped in to fund the project. Estimates suggest, the project would increase trade in the South Asian region by 60 per cent.

This road project will cover Manipur and West Bengal in the Indian side. The project will include two highways in Manipur, upgradation of 122 km long Siliguri, Mirik, Darjeeling, widening of 60 km long national highway on the border with Bengal and Bangladesh, and construction of 123 km of road outside Koltata worth $ 250 million.

The move follows signing of a landmark motor vehicles deal by the country’s road transport and highways minister Nitin Gadkari, in Thimphu – the capital of Bhutan, last year, which envisaged regulating inter-movement of people, passengers and cargo between the South Asian countries.