Global digital payment transactions may have grown by 10% for first time: Capgemini

September 24, 2016

With digital payments gaining momentum across the globe, electronic transactions may have witnessed an unprecedented growth of 10 per cent in 2015, according to a latest World Payments Report 2016 (WPR) released by global consultancy firm Capgemini and banking major BNP Paribas. The report projected global digital payments transactions to have reached 426.3 billion in 2015, reflecting over 10 per cent growth from 2014, compared to a previous growth rate of 8.9 per cent.

The growth in digital payments transactions is largely being driven by strong economic growth in key developing countries, improved security measures such as EMV[1], biometrics as well as government initiatives designed to encourage electronic payments in these markets as the cost of cash continues to rise, the report said. The report noted growth in digital payments occurred across all regions, with developing markets experiencing the highest rates — 16.7 percent — and mature markets growing at 6.0 per cent, although mature markets still accounted for 70.9% of total global volumes.

For the first time, China surpassed the U.K. and South Korea in digital transaction volumes, taking fourth position among the top ten markets globally, behind the U.S., the euro zone and Brazil. “FinTechs as well as the creation of Innovation Labs in banking are establishing new precedents for developing superior customer journeys,” said Anirban Bose, Head of Banking and Capital Markets, Capgemini. “The key now is in the mix of the partnerships and collaboration that can be done to drive out the most innovative digital services possible at the right ‘moments of truth’ along the customer journey.”

The report said cards remain the fastest growing digital payments instrument since 2010, while cheque usage continues to decline. Immediate payments have the potential to drive growth in digital transactions as an alternative to cash and cheques, but efforts are needed to educate stakeholders, provide more value-added services and upgrade infrastructure at merchants and corporate companies.

A number of banks already have started to adopt a ‘digital-first’ mindset. According to the WPR, 79 per cent of bank executives now view FinTechs as partners. Banks could have additional opportunities to further drive innovation in transaction banking by opening up their internal systems through open application programming interfaces (APIs) and leveraging the requirements of the Payment Services Directive II.

27 more make the cut for Smart City

September 20, 2016

Smart cities to take shape in one year

Twenty seven more cities from 12 states have joined the list of smart cities in the third round, including five from Maharashtra. These 27 cities will need an investment of close to Rs 67,000 crore. With this new inclusion, 60 cities have now been selected by the urban development ministry in three rounds that covered 27 states and union territories (UT). Only nine more states and UTs are still to get on board, including Uttarakhand and Jammu & Kashmir.

Maharashtra has bagged five cities – the maximum number in this round – and which includes Thane, Nashik, Nagpur, Kalyan-Dombivali and Aurangabad.

Poll-bound Uttar Pradesh has three cities on the list including Prime Minister Narendra Modi’s constituency of Varanasi. The other two cities are Kanpur and Agra. Four cities each from Tamil Nadu and Karnataka have also made it to this third list, followed by three from UP and two each from Punjab and Rajasthan. One city each from Madhya Pradesh, Andhra Pradesh, Odisha, Gujarat, Sikkim and Nagaland were also selected in this round.

Sikkim and Nagaland are the latest entrants from north-east India to enter the government’s Smart City mission. According to the urban development ministry, an investment of Rs 1.44 lakh crore has been proposed for the 60 smart cities announced so far, under the smart city plan. Around 82 projects are under implementation from the first batch of 20 smart cities while implementation for 113 projects are expected to start soon. The ministry said smart cities will be seen taking shape in the next year or so.

With UPI backing, ToneTag vouches to complete transactions in 3 seconds

September 19, 2016

The Unified Payment Interface (UPI) that was launched recently by the National Payments Corporation of India (NPCI) – is already changing customers’ experience in payments, and also challenging companies to innovate and break new ground. ToneTag – a sound based technology that enables contact-less transfer of the UPI virtual address at the point of sale, without the merchant or customer having to manually divulge the information – is aiming to make end-to-end digital payments in three seconds, with the help of UPI at the back-end.

Customers using ToneTag can make contact-less payments from their feature phones, smartphones or tablets with just a single click, using nothing but sound waves! ToneTag reduces digital acceptance costs for merchants by removing hardware dependencies. ToneTag, which is available as an SDK (Software Development Kit), works over almost any device with a microphone or a speaker, irrespective of platform or specifications.

“While UPI simplifies and quickens the speed of payments at the server/back-end level, ToneTag plays a vital role in enabling quick contact-less payments at the ground level. The ToneTag technology has the capability to completely transform the way people pay during an offline in-store transaction. In the coming days, banks will offer UPI through a ToneTag experience,” says Kumar Abhishek, founder and CEO, ToneTag.

The ToneTag sound-based technology has already been evaluated and subsequently appreciated in a May 2016 document issued by NPCI. ToneTag can be integrated with any app that operates on almost any device or platform to allow secure and contact-less exchange of payment information. The company is targeting around 25 million customers by December 2016 and will be able to pay at 45 thousand UPI merchant terminals.

Maharashtra CM promises Metro for Kalyan-Bhiwandi-Dombivli

September 19, 2016

“The Maharashtra Government will definitely bring Metro to Kalyan-Bhiwandi-Dombivli. The DPR is in progress and a decision will soon be taken once technical formalities are completed”, said Honourable Chief Minister Devendra Fadnavis, today, after laying the foundation stone for the two 6-lane bridges to be constructed over Ulhas Creek at Motagaon and near Durgadi fort. He also said that the purpose of his forthcoming America visit is to “sign an agreement with software giant Oracle to convert Kalyan-Bhiwandi-Dombivli into smart cities.” The Chief Minister further promised to take up more infrastructure projects to ensure total development of the metropolitan region.

The Honourable Guardian Minister for Thane district, Eknath Shinde; the Honourable State Minister for IT and Medical Education, Ravindra Chavan and Honourable MP Kapil Patil thanked the state government for showing keen interest in the development of the area and the metropolitan region in general. It was only a few months back the CM had laid the foundation stone for a 3-km long flyover at Vanjarpatti on Bhiwandi-Kalyan road running from Rajiv Gandhi Chowk to Saibaba Mandir.

“Today we have one two-lane creek bridge and when the new bridge is completed the motorists will have eight lanes to experience a congestion free drive”, said UPS Madan, Metropolitan Commissioner, MMRDA. Honourable MLAs Narendra Pawar, Shantaram More, Mahesh Choughule, Kisan Kathure, Ganpat Gaikwad and Sarpanch of Village Kon, Vandana Patil were also present on the occasion.

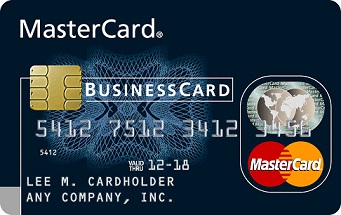

MasterCard to help Smart Cities with innovative payments solution

September 11, 2016

MasterCard – one of the leading payment gateways of the world – is keen to partner with the government for its smart city vision by developing innovative solutions in the payments space. The global payments solution major has developed several technologies which offer customers simple and secured payments solutions. For example Masterpass, which with any bank wallet app makes life easier for the consumers, allows them to use their mobile banking app and purchase items at physical stores using a merchant specific code.

Similarly, it has introduced Mastercab – an in-app checkout service to book and pay for cabs, enabled by Masterpass.

Another interesting offering is “Selfie Pay” – a unique mobile payment verification service from MasterCard that aims to simplify the online shopping experience for consumers. All consumers need to do is use the phone camera to click a selfie as part of a two-step authentication process when shopping on the mobile. “As a global payments technology company, MasterCard has been enabling cities to become livable, sustainable and more inclusive. MasterCard is keen to partner with the Indian government for the Smart Cities vision. We can develop innovative solutions that make the lives of people and businesses easier – and that help India further strengthen its competitive position in the world economy,” said Mr. Porush Singh, Country Corporate Officer, India & Division President, South Asia, MasterCard.

MasterCard has tied up with the Skoch Group, a think tank dealing with socio-economic issues. At a recent summit which focused on ‘Smart India, Shrestha Bharat – From Promises to Delivery’, held at Hyderabad, some of the products of MasterCard were showcased to visitors.

Being Street Smart the public way

September 2, 2016

The SmartShehar, (Hindi word for city) mobile app has been around for about four years. Meet Chetan Temkar, its creator, who envisaged smart mobility long before ‘smart’ became a buzzword. After two decades spent in the US, Temkar knows a thing or two about smart commuting and smart mobility in large cities.

Extracts from an interview :-

Tell us how SmartShehar happened.

We started in 2006 when we created a car pooling mobile app which was short message service (SMS) based. I got into mobile apps in 2011 and thought about what could be done in Mumbai that is useful. In a city where over 30 lakh people use the public transport systems daily, I realized that with regard to buses, there was no information, unlike the trains. Even today, if you ask anybody about buses, no one knows too much about them. Hence, we decided to create a location-based application for buses.

What does the application do?

In short, it figures everything out. It finds out, in connection with your location in real-time, which buses are available and the nearest stops. If you then click on a bus, it shows all its stops on a map. If you then get into the bus, it shows you the next stop so you don’t have to keep asking the conductor. We have also done interesting things like showing the landmarks around every bus stop as people are mostly not aware of the colloquial names for these stops. It’s a very intelligent application. Moreover, based on the back-end intelligence we have about traffic, we try to figure out how long a bus will take to reach a particular point. This does not mean it is foolproof, because BEST does not have a tracking mechanism. However, we have suggested to them we’ll provide this functionality free of charge. All they need to do is buy a phone and put it in the bus. The bus driver enters the bus number, picks out the start and end stops and starts his journey. After that, the app does everything else.

In developed countries, all this information is relayed on display panels in the bus shelter itself. The problem with this in India, as BEST pointed out to us, is that people will either break the panels or take them away. Therefore, it is better to have the information on your smart-phone, and maybe this is even better as you don’t even have to be at the bus shelter. You could be at a pub nearby with a friend but you are informed always about the bus through your phone! Therefore, this is a good example of taking a global solution and localising it for the Indian context.

How many downloads do you have so far?

We have more than 250,000 downloads.

Have they peaked out at that level?

We generally get about 400-500 downloads daily if you count the other app as well. We have an app called Jumpin Jumpout which is a very ambitious project. We have parts of it ready. It allows you to share your care with your friends, or a group of people, friends of friends, or with strangers. The operation is very optimized. It is also being used in the US. With this app, as soon as you create a trip, it sends a notification to all the people on the route or to selected people. These people get notifications that you have created a trip. Now, when you leave, actually start moving, people again get a notification about that.

The app is intelligent enough to figure out the speed at which you are moving so it knows that you are now in the car since you must be moving at a pace faster than if you were walking. It has a lot of logic built in.

What are the challenges you are facing here?

It is very difficult to get public data. We have been talking to the government to make this data available to website owners and app makers. We have also offered to put all the data in a certain format. If the government does this, then it will open up these kinds of services. I’m hoping that now with the focus on start-ups by the current government, they’ll push these kinds of things. Once they make data open, then us app-makers can get to work. When we had gone to Western Railways, we faced a very high-handed and arrogant attitude from the official in charge there. In the US, where I worked for about two decades, it is exactly the opposite. They welcome you with open arms. However, the attitude of BEST has been great. Of course, we still have to ask many times, etc., but generally, they have been much better compared to the Railways.

What is your vision? What do you want to finally do with this app?

We envision a transparent, cashless, and effortless system to use. For instance, if I am at Andheri and want to go to Churchgate, the app should show me different options. I should be able to see trains, buses as well as people offering rides in their own cars. The app should not only show me all these options but also list the quickest way for me to reach my destination along with other details such as who has air-conditioning, for instance. We already have about 70 per cent of these functionalities in our apps. We’ll also have a seamless and transparent system which will enable one to pay through the mobile, whatever form of transport he or she decides to use. I believe the unique thing about us is we are taking an integrated approach.

The big data analytics platform we are building in the back-end will allow the government to make intelligent public policies. It will allow them to prioritize issues and also allow them to predict problems. This is a very ambitious goal but we feel such platforms are critical for the smart cities of the future.

How are you funded and are you making money yet through the app?

We are not yet making money. We are hoping for enough users. For SmartShehar, we have 2.5 lakh downloads already and we can leverage that. We are currently funded through friends and family. I have a partner and we have an office in Mumbai. There are about 10 of us, seven of whom are core staff and three or four associates work on a part-time basis. At this stage, we can’t reveal much as this relates also to our competitive edge. However, once we have a fixed set of users over a longer period who have an engagement with the app, we can look at ways to monetize what we are doing. We are not worried about that right now. Our goal is just to get as many downloads as possible at this point.