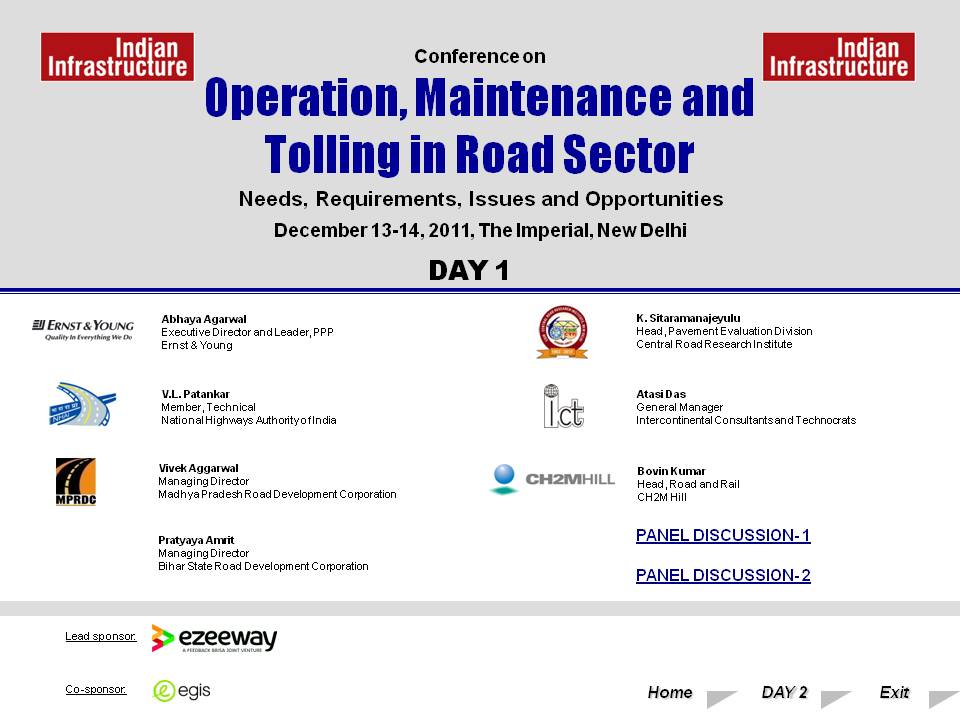

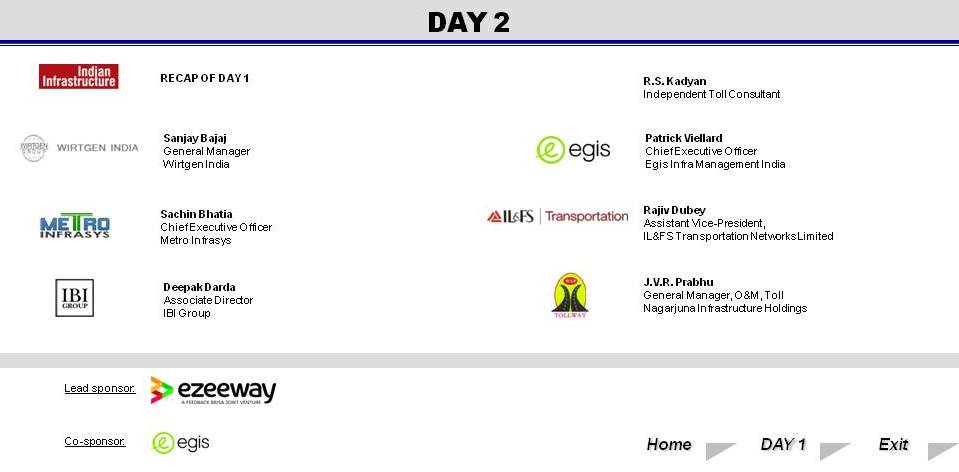

Conference on Operation ,Maintenance and Tolling in Road Sector

December 31, 2011

Conference on Operation , Maintenance & Tolling in Road Sector

December 13-14 ,The Imperial ,New Delhi

Presentation by Mr. Abhaya Agarwal

Presentation by Mr. Bovin Kumar – CH2M – Future Financing Road Maintenance_V0

ID India Expo 2012

December 30, 2011

ID India Expo 2012 is India’s only one of its kind and the leading international trade fair andconference for identification technologies incorporating Smart Cards, RFID-NFC, Bio-metrics and e-Security technologies and their applications and solutions.

Date & Venue ID INDIA Expo 2012

Date: February 22-24 ,2012

Timings: 10:00 AM onward

Venue : Pragati Maidan , New Delhi

IDIndiaExpo_CALL FOR PAPERS_Identifications for a Networked India

IDIndiaExpo_CALL FOR PAPERS_RFID-NFC and Contactless Technologies and Applications

Take advantage of the festive atmosphere which will be prevailing from February 22 – 24, 2012 atthe Pragati Maidan, New Delhi – India. These three energetic and intense days will provide a special opportunity to combine socializing and networking, with informative conferences, workshops and symposiums as well as a few amusing retrospective’s.

Visit us at www.idindiaexpo.com or email us at [email protected]

Annual National Conference on Road Infrastructure in India 2011

December 28, 2011

[nggallery id=5]

Dear Reader

Indian tollways team is glad to share the moments of conference which was successfully conducted by Annual National Conference on Road Infrastructure in India 2011 on 6th Dec 2011 at Mumbai. 14 speakers and about 100 delegates were presented in the conference.

Theme of the conference was Planning, Designing, Modernization & Investment for Indian Roads to match International standards.

Confirm speakers for the conference were:

- Shri Nitin R.Gokarn, Joint Secretary, Ministry of Road Transport & Highways

- Mr. Sudhir Hosingh, CEO-Roads, Reliance Infrastructure Limited

- Prof M.N.Sree Hari, Advisor to Gov. Karnataka T.T & Infrastructure

- Mr. Satish Pendse, President – Highbar Technologies Limited -Hindustan Construction Company

- Mr. Alon Globus, Director, i-Tec-India

- Mr. N.K.Sinha, Chairman International Road federation Indian Chapter

- Shri Sudhir Thakre, Secretary, PMGSY

- Shri Ajay Saxsena, PPP Expert, Asian Development Bank (ADB)

- Mr. N.N.Kumar, Dy. Chairman, JNPT

- Mr. Rajesh Rohatgi, Sr. Transport Specialist, World Bank

- Mr. Brijesh Koshal, MD, Daiwa Capital Market

- Mr. Kamal Bali, President & CEO, LeeBoy India Construction Equipment (P) Ltd

- Mr. Sachin Bhatia, CEO, Metro Infrasys p Ltd.

- Ms. Archana, Prof. RV College of Engineering

- Dr. S. L Dhingra, Chair Professor, IIT Mumbai etc.

Presentation By Mr. A.V.Sinha on The Way Forward in Highway Sector

Presentation by Mr. Suresh Ramchandrani on MSRDC Role

Presentation By Mr. P.Y.Deshmukh on SPV Projects for Port & Rail Connectivity

Presentatin by Mr. Rajesh Rohatgi on OPRC – RR

Presentation by Mr. Sachin Bhatia on ETC in India

Presentation by Mr. Vivek Singh on Towards a Sustainable Logistics Network in India

NHAI terminates Goa contract to IRB Infrastructure

December 27, 2011

IRB Goa Tollway Pvt. Ltd. will claim compensation as per Termination payment provisions of the Concession Agreement.

IRB Infrastructure Developers Ltd has announced that the National Highways Authority of India (“NHAI”) had issued Letter of Award (“LOA”) on January 05, 2010 to the Company for the Project of Four Laning of Goa/ Karnataka Border to Panaji – Goa stretch of NH-4A from Km 84.000 to Km 153.070 in the State of Goa on BOT Toll Basis on DBFO pattern (the “Project”). The Company had subsequently incorporated Special Purpose Vehicle (SPV) i.e. IRB Goa Tollway Pvt. Ltd. – wholly-owned Subsidiaries of the Company for implementation of this Project. IRB Goa Tollway Pvt. Ltd. had executed Concession agreement with the NHAI in February 2010 and subsequently the Project had also achieved financial closure in March 2010. Construction period of the Project was 30 months.

However, NHAI could not provide necessary Land for implementation of the Project. Considering substantial delay in providing the Land, the Company had removed the Project from its Consolidated Order Book as on September 30, 2011 as a measure of Good Corporate Governance and accordingly modified Order book was represented in the presentation uploaded on the Company’s website.

Now, the Company have received a formal letter from NHAI informing the Company, termination of this concession agreement of the Project due to their inability to provide necessary Land for implementation of the Project. In this regard, IRB Goa Tollway Pvt. Ltd. will claim compensation as per Termination payment provisions of the Concession Agreement.

Source: indiainfoline.com

Indian stock market and companies daily report (December 26, 2011, Monday)

December 27, 2011

Indian markets are expected to open in the green following positive cues from opening trade in most of the Asian markets today and gains in US markets on Friday. There was quite a lot of volatility, but the Indian markets managed to end in the green, gaining close to 1.5% over the last week.

US stocks closed higher on encouraging economic reports as the number of Americans that applied for unemployment benefits dropped last week to the lowest level since April 2008 in the latest sign that the job market is healing. The Conference Board also reported that its measure of future economic activity had a big increase in November. It was the second straight gain, signalling that the US economy is picking up some speed.

The markets will closely track the developments on the domestic front; RBI is likely be more watchful now as moderating inflation is likely to resolve the predicament of trimming interest rates in order to support growth. Nonetheless, one cannot rule out the pessimism surrounding the policy paralysis on the macro front which, in tandem with weakening of global cues, can reverse the market directions.

Markets Today

The trend deciding level for the day is 15,774 / 4,724 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 15,876 – 16,014 / 4,754 – 4,794 levels. However, if NIFTY trades below 15,774 / 4,724 levels for the first half-an-hour of trade then it may correct up to 15,636 – 15,534 / 4,684 – 4,653 levels.

Increase in NRE FD rates

Following the deregulation of NRE Savings and Fixed Deposit rates by the RBI, several banks, including smaller private banks such as Yes Bank as well as larger ones such as HDFC Bank have aggressively increased the rates on these deposits. NRE FDs are rupee denominated accounts meant for NRI customers on which the interest earned is tax-free. For banks, these deposits are a source of raising rupee funds just like ordinary domestic FDs.

Hence, following the deregulation, several banks have increased the rates offered on these accounts close to their domestic FD rates (as in case of HDFC Bank offering 8.5% on NRE FDs less than Rs.15 lakhs vs. 9.25% on domestic FDs) or in some cases equal to their domestic FD rates (as in case of Yes Bank offering 9.6% on both domestic and NRE FDs as well as 7% on domestic and NRE savings accounts greater than Rs.1 lakh). Prior to the deregulation, interest rate on NRE FDs had been increased on November 23, 2011, by 100bp to LIBOR+275 bp (which worked out to about 3.75-4%). Considering that the interest on these FDs is tax-free, at about 8.5-9.5%, in our view this represents a compelling return (and a massive jump from the rate hardly a couple of months back of 2.75-3%), which could attract significant NRI inflows into the country.

Within the banking sector, Federal Bank and South Indian Bank have a disproportionately large share of NRE deposits in their overall funding mix at about 12% and 8.5%, respectively. Immediately post the deregulation, both the banks had increased their NRE FD rates to around 6.5%, but following the recent moves by other private banks, Federal Bank has also raised the rate to 8.25-9.10% and South Indian Bank’s management has also indicated that by Monday it will hike NRE FD rates to similar levels (management has indicated that it is unlikely to hike rates on NRE savings account). Hence, the low-cost advantage of these FDs vis-à-vis domestic FDs is expected to erode going forward. Also, so far, rates on NRE savings accounts were higher than NRE FD rates prior to the deregulation, but now with NRE FD rates being more than 500bp higher, a large part of NRE savings balances of these banks are also likely to move to NRE FDs.

Assuming that the entire NRE term and savings balances re-price gradually over the next one year to the new NRE FD rates, the impact on the NIMs could be up to 35bp for South Indian Bank and up to 45bp for Federal Bank. In any case, both these stocks (along with other older private sector banks) have outperformed of late, and current valuations at about 1x P/ABV are significantly higher than mid-size PSU banks with similar or better fundamentals. Accordingly, we downgrade both stocks to Neutral.

IRB’s Goa road BOT project terminated by NHAI

IRB’s Goa road BOT project (TPC: Rs.833cr) has been terminated by NHAI (formal letter received by IRB) due to NHAI’s inability to provide land for implementation of this project. This move by NHAI was on expected lines as IRB had removed this project from its order book in 2QFY2012 and subsequently we had factored the same in our model (read IRB 2QFY2012 result update). Further, according to management, IRB will claim compensation charge as per the provisions of the concession agreement.

Project details: IRB had received LOA from NHAI on January 5, 2010, for the four laning of Goa/ Karnataka Border to Panaji – Goa stretch in Goa on BOT toll basis. The company had subsequently incorporated SPV – IRB Goa Tollway Pvt. Ltd. (wholly owned subsidiary of IRB) for the project’s implementation. IRB Goa Tollway Pvt. Ltd. had executed concession agreement with the NHAI in February 2010 and subsequently the project had also achieved financial closure in March 2010. Construction period of the project was 30 months. However, NHAI could not provide necessary land for implementation of the project.

We have arrived at an SOTP-based target price of Rs.182/share, which implies an upside of 30.0%. Hence, we recommend a Buy rating on the stock.

Monnet Ispat Board approves share buyback

Monnet Ispat Board has approved share buyback upto Rs.100cr from the open market at a price not exceeding Rs.500/share. We expect the company to finance the buyback program from its internal accruals as it has been consistently generating quarterly EBITDA in excess of Rs.100cr. The share buyback could boost Monnet Ispat’s FY2013 EPS by 3-5%, depending on the average cost of shares bought back. We maintain our Buy recommendation on the stock with an SOTP target price of Rs.528.

Discontinuation of coverage

We have discontinued coverage on the following stocks: Electrosteel Castings, Godawari Ispat, Prakash Industries, Sarda Energy, Gujarat Gas, Gujarat State Petronet, Indraprasth Gas and Petronet LNG.

Economic and Political News

– Energy deficit may rise up to 15% as weak rupee hurts coal imports

– Forex reserves dip by US$4.67bn

– FDI dips 50% to US$1.16bn in October 2011

– State run banks told to discard fast-track promotion policies

Corporate News

– Oil Ministry says no provision for penalty in RIL’s KG-D6 contract

– Power trading firms hit by payment delay

– Domestic airfares fall as capacity rises

– Coal India will switch to new pricing mechanism from January 2012

Source: stockmarketsreview.com

IRB Infra project cancellation just a one off case: NHAI

December 27, 2011

The National Highways Authority of India cancelled the Goa road project that it had awarded to IRB Infrastructure in January 2010 due to the inability to acquire land for the project.

In an interview to CNBC-TY18, AK Upadhyay, chairman of NHAI says, this is just one off case. “I don’t think this is a serious concern,” he adds.

He expects land acquisition costs to rise going forward.

Upadhyay expects awards of close to 7,000 km by year-end.

Below is the edited transcript of his interview with CNBC-TV18’s Latha Venkatesh and Sonia Shenoy. Also watch the accompanying videos.

Q: The most disturbing news we heard lately was the cancellation of Goa road project given to IRB Infra because of the inability to acquire land. Can you just confirm this for us? How disturbing it is that you are not able to acquire land?

A: This is just one off case. In some states, we do face problems, but you don’t take it as a repetitive case. The other projects are going on very well. It is just one-two projects, out of 40-50 projects that we are going to bid this year. So, I don’t think this is a serious concern.

Q: What went wrong? Where did the resistance and the inability to acquire land come from?

A: The state government has solutions. Because the alignment was passing through some fishermen’s areas and they wanted to have an elevated highway for a very long stretch, it made it difficult to fund it. We had to restructure the project. So, the project as it was structured that could not go ahead. So, we had to cancel the bid. I would again say this is a one off case.

Q: What kind of interaction have you had with IRB on this and penalty that you may have to pay them?

A: I don’t think so because this is not at the award stage, so no liability has yet occurred. But I don’t think there should be any major penalty.

Q: How much are you expected to raise via the bond issue? hHw much demand do you see for these kind of tax free issuances at this point?

A: Our perception is that the bonds will be highly in demand. We hope to have full subscription. We are going for first tranche of Rs 5,000 crore with option to retain up to Rs 10,000 crore. From whatever feedback we have got, our impression is that this is going to be very successful.

Q: How many projects in 2011 went on a premium?

A: Let me talk of this fiscal starting from April 1, out of 33 projects, we have awarded so far of over 4300 km, 22 have gone on premium.

Q: In that case, would you consider increasing the viability gap funding for those that did not go at a premium?

A: Viability gap funding has 40% cap. If you over 40%, you might as well fund it entirely from public funding. Therefore, it is a rational limit. We don’t think it’s necessary to increase that. But what it means is that the funds we are getting it would help us in case of any increase land acquisitions cost. After the viable projects under BoT toll are exhausted, we will have to go for more and more EPC projects. That would be almost entirely public funded. So, therefore, this premium is good for us, it has cushioned for future years.

Q: From now, up until FY13, what is the order target that you have? How many have been awarded? How many you expect government to approve?

A: To give you a picture of this financial year, the total target we had set was 7,300 km. This was about 40% more than last year’s target. We are on course. We have awarded over 4,300 km. Another 1,000 km of the bids are in the pipeline either in evaluation or the bids have to come shortly. So that means that very shortly we will be crossing 5,300 km. Another 2,000 km of 14 projects are in various stages of evaluation and approving process.

Source: moneycontrol.com

Major achievements of Road Transport Ministry in 2011

December 26, 2011

A length of 3800 km is proposed to be funded from a World Bank loan of US $ 2.96 millions and the balance length is proposed to be taken up through budgetary resources.

Improvement of road connectivity in Left Wing Extremism (LWE) affected areas: The Union Government has approved a scheme for development of about 1,125 km of National Highways and 4,352 km of state Roads in Left Wing Extremism (LWE) affected areas as a special project estimated to cost about Rs. 7,300 crore.

During the year 2011, works in a length of 1127 km costing Rs. 1593 crore have been awarded upto November, 2011.

Special Programme for 2-laning of entire balance NH network not covered under any approved programmes: – Ministry of Road Transport & highways has taken initiatives to develop 6,700 km of single lane / intermediate lane National Highways to minimum 2 lane standards on corridor concept. A length of 3800 km is proposed to be funded from a World Bank loan of US$2.96mn and the balance length is proposed to be taken up through budgetary resources.

During the year 2011, works in a length of 699 km costing Rs. 1675 cr have been awarded. Consultancy studies for preparation of Feasibility study/ DPRs for the entire length of 3800 km to be funded out of World Bank assistance are in progress and targeted to be completed by March, 2012

Special Accelerated Road Development Programme for North-East region (SARDP-NE):

The scheme has been envisaged to be taken up under three parts as under:

- Phase ‘A’ of SARDP-NE approved by the Government envisages improvement of about 4,099 km length of roads (2041km of NH and 2058 km of state roads). The SARDP-NE Phase A is targeted for completion by March, 2015.

- Length sanctioned & awarded during the calendar year up to November, 2011 – 91 km

- Length completed during the calendar year up to November, 2011 – 10 km

- Work in progress as on 30th November, 2011 is 1608 km.

Phase ‘B’ of SARDP-NE, covering 3723 km (1285 km NHs and 2438 km of state roads) has been approved for DPR preparation only and so far, DPRs for about 450 km have been completed (up to 30th November, 2011)

Special Package for Arunachal Pradesh: The Arunachal Pradesh Package for Road & Highways involving development of about 2319 km length of road (1,472 km of NHs & 847 km of State / General Staff / Strategic Roads) has also been approved by the Government. Projects on 776 km are to be taken up on BOT (Annuity) mode and the balance 1,543 km is to be developed on EPC basis. The entire Arunachal package is targeted for completion by June, 2015.

Length sanctioned & awarded during the calendar year and work in progress as on 30th November, 2011 – 311 km

Development of NHs entrusted with State PWDs which are not covered under any approved programme such as NHDP, SARDP-NE etc.

Physical progress of non-NHDP sections of National Highways during 2011-12:

| Sl No | Category | Target* | Achievement* |

| 1 | Improvement to low grade (kms) | 1.00 | 3.50 |

| 2 | Widening to 2 lanes (kms) | 450.00 | 392.40 |

| 3 | Strengthening (kms) | 450.00 | 342.91 |

| 4 | Improvement of riding quality (kms) | 1200.00 | 1364.42 |

| 5 | Widening to 4 lanes (kms) | 60.00 | 33.07 |

| 6 | Bypasses (Nos) | 2 | 2 |

| 7 | Bridges / ROBs (Nos) | 50 | 53 |

| * Up to October, 2011 | |||

Highways Wing

Cabinet Committee on Infrastructure (CCI) during the calendar year 2011 has approved 31 Road projects for a length of about 4318 Kms. with Total Project Cost of Rs. 41,109.03 Crores and projects for 4036 Kms. have been awarded. Detail of the projects approved by the CCI during the year 2011 is as follows:

| S. N | Name of the Project | State | NH No. | NHDP Phase | Length (in KM) |

TPC (in crore) | Approved by CCI in its meeting held on |

| 1 | Beawer-Pali-Pindwara (4-laning) |

Rajasthan | 14 | III | 244.12 | 2388 | 20.04.2011 |

| 2 | Ahmedabad-Vadodara (6-laning) |

Gujarat | 8 | V | 102.3 | 2125.24 | 06.04.2011 |

| 3 | Kota-Teendhar (Jhalawar) (2/4-laning) |

Rajasthan | 12 | III | 88.09 | 530.01 | 06.04.2011 |

| 4 | Nagpur-Wainganga Bridge (4-laning) |

Maharashtra | 6 | III | 45.43 | 484.19 | 20.04.2011 |

| 5 | Eastern Peripheral Expressway | Haryana/U.P | NE-II | 135 | 2699 | 20.04.2011 | |

| 6 | Panikolli-Rimuli (4-laning) | Orissa | 215 | III | 166.197 | 1410 | 09.06.2011 |

| 7 | Jabalpur-Lakhanadone (4-laning) |

Madhya Pradesh | 7 | IV-A | 80.825 | 776.76 | 23.06.2011 |

| 8 | Chhattisgarh/Orissa Border Aurang (4-laning) |

Chhattisgarh | 6 | IV-A | 150.4 | 1232 | 21.07.2011 |

| 9 | Walayar – Vadakkancherry (4-laning) |

Kerala | 47 | II | 54 | 682 | 21.07.2011 |

| 10 | Jabalpur-Katni-Rewa (4-laning) |

Madhya Pradesh | 7 | IV-A | 225.686 | 1895.45 | 04.08.2011 |

| 11 | Meerut – Bulandshahar (4-laning) |

Uttar Pradesh | 235 | IV-A | 66.043 | 508.57 | 11.08.2011 |

| 12 | Gwalior – Shivpuri (4-laning) | Madhya Pradesh | 3 & 75 | IV-A | 125.3 | 1055 | 05.09.2011 |

| 13 | Shivpuri – Dewas (4-laning) | Madhya Pradesh | 3 | IV-A | 320.21 | 2815 | 05.09.2011 |

| 14 | Poonamallee-Walajahpet (6-laning) |

Tamil Nadu | 4 | V | 93 | 930 | 05.09.2011 |

| 15 | Kishangarh-Udaipur-Ahmedabad (6-laning) |

Rajasthan/Gujarat | 79A,79, 76, NH-8 | V | 555.5 | 5387.3 | 15.09.2011 |

| 16 | Hospet-Bellary-Karnataka/AP Border (4-laning) | Karanataka | 63 | IV-A | 95.44 | 910.08 | 30.09.2011 |

| 17 | Lucknow-Sultanpur (4-laning) | Uttar Pradesh | 56 | IV-A | 125.9 | 1043.51 | 30.09.2011 |

| 18 | Birmitrapur – Barkote (4/2-laning) |

Orissa | 23 | IV-A | 125.615 | 778.15 | 25.10.2011 |

| 19 | Vijayawada – Machilipatnam (4-laning) |

Andhra Pradesh | 9 | III | 64.611 | 606 | 25.10.2011 |

| 20 | Angul – Sambalpur (4-laning) |

Orissa | 42 | IV-A | 153 | 1220.32 | 16.11.2011 |

| 21 | Obedullaganj – Betul (4/2-laning) |

Madhya Pradesh | 69 | III | 121.36 | 912 | 16.11.2011 |

| 22 | Mah/Kar Border – Sangareddy (4-laning) |

Karnataka/ Andhra Pradesh |

9 | III | 145 | 1266.6 | 16.11.2011 |

| 23 | Hospet-Chitradurga (4-laning) |

Karnataka | 13 | III | 120.03 | 1033.65 | 16.11.2011 |

| 24 | Agra – Etawah Bypass (6-laning) |

Uttar Pradesh | 2 | V | 124.52 | 1207 | 16.11.2011 |

| 25 | Raipur – Bilaspur (4/6-laning) |

Chhattisgarh | 200 | IV-A | 126.525 | 1216.03 | 16.11.2011 |

| 26 | Lucknow – Raebarelly (4-laning) |

Uttar Pradesh | 24-B | IV-A | 70 | 635.9 | 16.11.2011 |

| 27 | Cuttack – Angul (4-laning) |

Orissa | 42 | III | 112 | 1123.69 | 16.11.2011 |

| 28 | Etawah – Chakeri (Kanpur) (6-laning) |

Uttar Pradesh | 2 | V | 160.21 | 1573 | 16.11.2011 |

| 29 | Rampur – Kathgodam (4-laning) |

Uttar Pradesh/ Uttarakhand | 24 | III | 93.226 | 790 | 16.11.2011 |

| 30 | Mahulia – Baharagora – Kharagpur (4-laning) |

Jharkhand / West Bengal | 6 | III | 127.13 | 940 | 24.11.2011 |

| 31 | Solapur – Mah/Kar Border (4-laning) |

Maharashtra | 9 | III | 100.6 | 934.58 | 24.11.2011 |

| Total |

National Highways Authority of India (NHAI)

In order to improve transparency and accountability NHAI has switched to e-procurement and e-tendering for all types of projects including BOT since July, 2011. In e-tendering mode 101 tenders have been floated by NHAI till 30.11.2011 of which 21 tenders are of BOT, 55 tenders are for Tolling on Reverse Auction and others of varied nature.

For Planning, Monitoring and Management of National Highways with the help of GIS based Satellite Imagery, specially in difficult areas like Left Wing Extremist (LWE), North-East (NE) and other States, inputs have been received from National Remote Sensing Center (NRSC), 20 National / International firms have been short-listed through a Global Tender. The work is expected to commence shortly.

Public grievance redressal system of NHAI made interactive with the help of user friendly social networking site viz. Face Book (available at http://www.facebook.com/pages/National-Highways-Authority-of-India/1865851480 28027). Between January, 2011 and November, 2011, more than 4 lacs persons have visited this site and about 3000 have registered themselves. NHAI’s officers are regularly replying to the public queries directly on the Facebook wall of NHAI. Concessionaries of BOT projects have been advised to provide link to their sites on NHAI Facebook wall – for quick response to road users.

To upgrade the existing Assets Management System by basing it on web-based Geographical Information System (GIS) for the purposes of planning, construction and operation and maintenance of National Highways. Global tenders have been invited for 15000 Kms of stretches having been identified for this on both BOT and EPC projects to cater to both asset management and project management.

All concession agreement documents between the NHAI and concessionaire are now available on NHAI website at http://www.nhai.org/concessionagreementcj.asp. CVs of key personnel’s of the Independent Engineers overseeing the BOT projects are being uploaded in phases on the NHAI website.

It has been decided to implement a combined state of the art Enterprise Resource Planning (ERP) for Ministry of Road Transport and Highways and National Highways Authority of India with the objective to integrate end to end business processes that were traditionally disjointed and share information through a common database. ERP when implemented will enhance the productivity and efficiency of both the organisations. Ground work of Functional Requirement Study has been completed.

NHAI has large number of legal cases including with its contractors / concessionaire and vendors. The entire system was handled earlier manually. A web based customized software has been developed by NHAI through which it will be possible to retrieve information on Arbitration, Writ Petitions, Land Acquisition cases, Civil Contract cases, Criminal Cases and Central Administrative Tribunal (CAT) cases and tackle these disputes better.

In order to track the progress of construction and maintenance of the National Highways, a state of the art system is being developed to capture information / photos / videos directly from the site using tablet / notepad / personal digital assistant (PDA) / mobile phones and its retrieval on desktop / laptop by all concerned on real time basis.

Annual Pre-qualification of Bidders:

With a view to implement the recommendations of BK Chaturvedi Committee NHAI has adopted Annual Pre-qualification of bidders during the year 2011. It has already completed the process of Annual pre-qualification and pre-qualified about 100 applicants/bidders. These applicants are not required to submit voluminous documents at project specific RFQ. They will only submit the pre-qualification letter issued by NHAI. This Annual pre-qualification is valid upto 31.12.2011. NHAI has again taken up fresh pre-qualification.

Tax Free Bonds

As per 2011-12 BE, NHAI would raise a sum of total Rs. 11900 crore out of which 54EC Bonds contribute Rs. 1,900 crore and Tax Free Bonds contribute Rs. 10,000 crore. The Government has authorized NHAI to issue, during the financial year 2011-12, tax free, secured, redeemable, non-convertible bonds aggregating to Rs. 10,000 crore. The draft shelf prospectus has been filed with BSE, NSE and SEBI. The issue is likely to open in the 3rd week of December 2011.

Outcome

Award of contracts

The pace of award of contracts has been accelerated to achieve the target of 20 kms in a day. As compared to achievement of award in 2009-10 of 3360 km and 5058 km in 2010-11, a total of highway length of 4036 km with total project cost of Rs. 36381.49 Cr. have already been awarded till November 2011. The balance is in advance stage of award for meeting the target of 7300 km planned for this year.

Feasibility Studies

As an advance preparation efforts have been made to keep the shelf of feasibility study available to increase the award of contracts beyond 7300 km. During the period from Jan’ 2011 to Nov’ 2011, Feasibility Studies of 6708 kms have been completed and out of which some are in pipeline for award.

Excellent Response from bidders

Despite the economic slowdown this year has witnessed a revival of interest among private investors and acceleration in award of projects due to new policy initiatives taken to usher in fair competition & transparency. NHAI has received record premiums in the projects which have been bid out in the current year. In fact in one of the projects, 6-laning of Kisangarh-Udaipur-Ahmedabad section of 560 kms fetched premium of Rs. 636 crore (with 5% annual increase). This trend is very encouraging and validates the policy framework for PPP projects that has been established. In 20 projects, higher premium have been offered by the bidders as compared to the approved estimate by CCI. Similarly in 6 projects, VGF grant demanded by the bidders are less as compared to approved estimate by CCI. As a result of this, the net present value (NPV) of savings on account of premium / grant quoted by the bidders as compared to the same projected by NHAI in respect of 26 projects is Rs. 21,070 crores.

Land Acquisition

Despite an adverse climate in the field regarding land acquisition and reluctance on the part of farmers to part away their land on current rate of compensation in the hope of getting better compensation under new Act which is likely to be effective shortly, sufficient progress has been made in the matters of land acquisition for national highways. In the current financial year 7800 hectares of land has been acquired till November, 2011 as compared to a total acquisition of 8533 hectares in 2010-11 and 6244 hectares acquired in 2009-10.

Source: indiainfoline.com

Opportunity in gloom

December 26, 2011

IL&FS Transportation Networks (ITNL) has seen its stock gradually slide from over Rs 360 last September to its new low (intra-day) of Rs 144 on Wednesday, thanks to weak sentiments in the global and domestic markets.

While it is already India’s largest player in road build-operate-transfer (BOT) projects, IL&FS Transportation Network last week added another feather in its cap when it announced the plan of its China foray. Analysts feel the move is unlikely to benefit it in the medium term, but they remain bullish on its Indian business.

Elara Capital Analyst Abhinav Bhandari says: “We are positive on the company due to its leadership position in the domestic road vertical, strong parentage of IL&FS, partnerships and bilateral contracts with state governments and relatively diversified and de-risked business portfolio.” Notably, stock valuations are now attractive, and, with interest rate cycle at its peak, things should improve in the times to come.

| PICKING UP SPEED | |||

| In Rs crore | FY11 | FY12E | FY13E |

| Net sales | 4,048.00 | 5,418.30 | 6,824.70 |

| Y-o-Y change (%) | 68.5 | 33.9 | 26.0 |

| Operating profit | 1,155.00 | 1,347.70 | 1,627.70 |

| Y-o-Y change (%) | 45.5 | 16.7 | 20.8 |

| Net profit | 433 | 447.3 | 527.7 |

| Y-o-Y change (%) | 25.9 | 3.3 | 18.0 |

| EPS (Rs ) | 22.3 | 23.0 | 27.2 |

| Y-o-Y change (%) | 25.9 | 3.3 | 18.0 |

| E: Estimates All figures are consolidated Source: Company, Analysts Reports | |||

At Rs 152, the stock trades at one-year forward (FY13) PE of 6.3 times, below its historic band of 7.5-13.5 times, as well as 11.2 times for its closest peer and India’s second-largest BOT player, IRB Infrastructures. Analysts expect an upside of over 50 per cent, given the average sum-of-the-parts (SOTP) of Rs 270.

Towards the Dragon

ITNL has been selected the preferred bidder for 49 per cent stake in Yu He Expressway Company by Chongqing Expressway Group. The project is a four-lane expressway of 58 km, connecting the Chongqing city with Hechuan County, with toll rights till June 2032. The acquisition worth $160 million (49 per cent stake), or around Rs 850 crore, is expected to be funded by debt.

According to a Sharekhan report, the expressway is significant because it connects to a major industrial belt in the Chongqing region, allowing the Chinese company to enjoy a consistent traffic flow through the year and offering a decent growth prospect. Though the project has been operational for the last 10 years and is profitable, the gains for ITNL may be limited in the medium term.

According to ITNL Managing Director K Ramchand, revenue growth will be marginal in the first few years, while addition to net profit will be less than 5 per cent. But it will substantially improve after the next 10 years (total term of the debt).

PINC Research Analyst Vinod Nair adds: “The relatively small size of the project, non-strategic fit (Chinese market not being a long-term policy of ITNL) and the requirement to fund would limit any near-term benefits.”

Stable core business

In India, ITNL’s 22 projects (about 9,458 lane km) is well divided in terms of region, clients (state and central) and revenues model (toll and annuity).

Amid a weakening economy, the company has been selective in bidding for NHAI projects for the past several quarters. The guidance for it was $1 billion worth of order wins in FY12. But it has not won any major order from NHAI so far in FY12. It has bagged only three state government projects worth Rs 870 crore.

However, this is not seen as a concern either by ITNL or analysts. “The cautious bidding would pay off in the long run,” notes the Sharekhan report. Besides, it has enough work, given the order book of Rs 8,900 crore, about four times its FY11 construction revenues.

The management has expressed its intention of continuing its conservative bidding strategy, as it feels competition will continue to remain high. Moreover, the bidding pipeline remains strong at around Rs 68,500 crore (9,500km).

High on debt

For now, high interest cost, given the consolidated debt-to-equity ratio (2.7 times) in the second quarter of FY12 is a concern. In the September quarter, operating profits rose 37 per cent (Rs 383 crore) on 42 per cent rise in income (Rs 1,282 crore), but a 72 per surge in interest costs (Rs 169 crore) restricted gross profit (profit before depreciation and tax) growth to 17 per cent (Rs 214 crore).

The management expects the debt burden to remain at higher levels on the back of increased execution of 12 under-construction projects that could keep interest costs high in the interim.

Positively, rates are peaking. Edelweiss Securities Analyst Parvez Akhtar Qazi believes that the company is one the best plays on peaking interest rates. “A 100-basis-point decline in interest rates increases our SOTP estimates of ITNL by 13 per cent,” he points out.

| PICKING UP SPEED | |||

| In Rs crore | FY11 | FY12E | FY13E |

| Net sales | 4,048.00 | 5,418.30 | 6,824.70 |

| Y-o-Y change (%) | 68.5 | 33.9 | 26.0 |

| Operating profit | 1,155.00 | 1,347.70 | 1,627.70 |

| Y-o-Y change (%) | 45.5 | 16.7 | 20.8 |

| Net profit | 433 | 447.3 | 527.7 |

| Y-o-Y change (%) | 25.9 | 3.3 | 18.0 |

| EPS (Rs ) | 22.3 | 23.0 | 27.2 |

| Y-o-Y change (%) | 25.9 | 3.3 | 18.0 |

| E: Estimates All figures are consolidated Source: Company, Analysts Reports | |||

Concession agreement signed for widening of Nechipu to Hoj road

December 26, 2011

he Nechipu – Hoj Section of NH-229 is a part of Trans Arunachal Highway. The construction of 2 lane Trans Arunachal highway from Tawang in Arunachal Pradesh to approaches to Bogibeel bridge in Assam was announced by the Prime Minister on 31st January, 2008 during his visit to Itanagar.

A Concession Agreement has been signed in the Ministry of Road Transport and Highways for “ Widening of existing road to 2-lane national highway standards from Nechipu to Hoj on hybrid BOT (Annuity) model under the Arunachal Pradesh Package of Roads and Highway. The Nechipu – Hoj Section of NH-229 is a part of Trans Arunachal Highway. The construction of 2 lane Trans Arunachal highway from Tawang in Arunachal Pradesh to approaches to Bogibeel bridge in Assam was announced by the Prime Minister on 31st January, 2008 during his visit to Itanagar.

The Trans Arunachal Highway is a very important Highway which runs across the State of Arunachal Pradesh. The project road will improve the internal connectivity of western districts of Arunachal Pradesh with Itanagar, namely Seppa, Bomdila, and foster socio-economic development of the whole of the State. Apart from this, the road would help in hydro power projects coming up in Arunachal Pradesh. The road would also greatly facilitate the security/ defence agencies to combat anti-national activities and threat on border areas.

-

Length of the Project: 311 km;

-

Total Project Cost (TPC): Rs. 1486 cr;

-

Civil construction cost of the project: Rs. 1255 crore

-

Construction period: 4 ½ years

-

Concession period: 17 years

-

Cash support during Construction period: Rs. 1004.0 crore

-

Semi Annual Annuity (25 nos.) : Rs. 39.0 crore each; to be paid to Concessionaire during maintenance period.

-

NPV in 2011-12 of Government Cash flow to the project @ 10% discount rate is Rs. 1077 crore.

This project have been approved by Cabinet/CCI in its meetings held on 9th January, 2009, 30th June, .2009, 4th March, .2010, 6th May,.2010 & 9th June,.2011; Tendering for 2 times were annulled owing to high annuity quotes;

The project is to be implemented on hybrid BOT (Annuity) model. This is a hybrid model under which 80% of the estimated construction cost will be disbursed to the concessionaire during construction phase and remaining construction cost and maintenance cost etc. will be defrayed through annuity payments. The target to complete 2-lane is by June, 2016. The concessionaire will also maintain the road for 12 ½ years after the construction period of 4 ½ years and Ministry will pay 25 semi-annual annuity to concessionaire during maintenance period of 12 ½ years.

Source: indiainfoline.com

WB’s proposed state highways authority to woo pvt investment

December 26, 2011

West Bengal’s proposed state highways authority will work to attract private investment in road infrastructure development, State Finance Minister Amit Mitra has said.

“With the state highways authority, West Bengal can undertake road projects on a Build-Operate-Transfer (BOT) basis,” Mitra told PTI.

The Mamata Banerjee-led government has proposed to create infrastructure through the PPP model, officials said.

A decision to set up a highways authority similar to the National Highways Authority of India (NHAI) is a step toward achieving goals in the road sector, sources said.

Mitra said, “The initial corpus for the authority has not yet been finalised and could be known when the proposal comes to the Finance Department.”

At present, the Public Works Department controls and maintains highways in the state. The state highway authority is likely to take over this role once it comes into place, officials said.

West Bengal has a total road network covering 92,023 km, of which National Highways comprise 2,578 km and state highways cover 2,393 km.

States like Jharkhand and Uttar Pradesh have already set up a state highways authority to improve their road infrastructure.

Source: business-standard.com